Yandex $YNDX (now delisted) was a great IPO. Investors lost a lot of money after the Russian invasion, resulting in the delisting of the multi-billion internet company. Yandex was the "everything" company serving Russia. They were both the "Google" and the "Amazon" of the region.

Over the past two years, the parent company embarked on a tortuous journey to divest the sanctioned assets and salvage what they could of the business.

What has emerged is Nebius Group $NBIS, a new Amsterdam-based, US-listed public company with over 1,300 employees and $2B in cash. The company's core is in the AI-centric cloud data center business, with several private AI companies in areas like data sourcing, autonomous driving, and education. The employee base also has an engineering concentration including cloud, AI, ML, LLM and data.

We still have a lot of work to do on this one (the IPO deck alone is 92 slides), and although it's been a long time coming, it just started trading yesterday.

This note will lay some groundwork for investors and help prepare us for the first company public ER on Thursday, October 31st.

We've reserved the rest of this post and our work on Nebius for our paid members.

Should Microsoft, Amazon, and Google be worried?

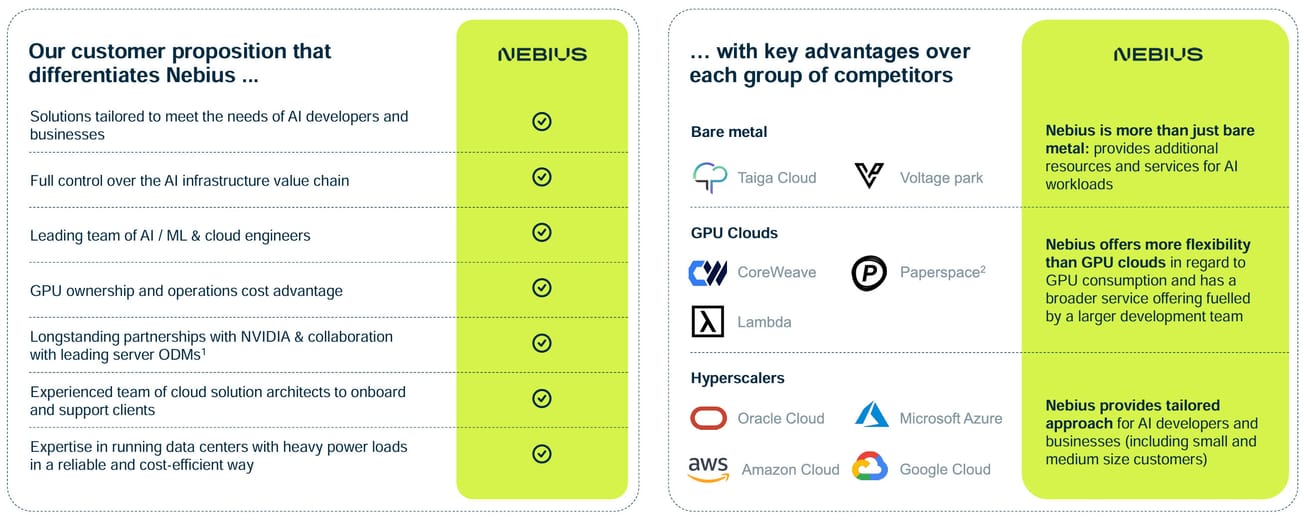

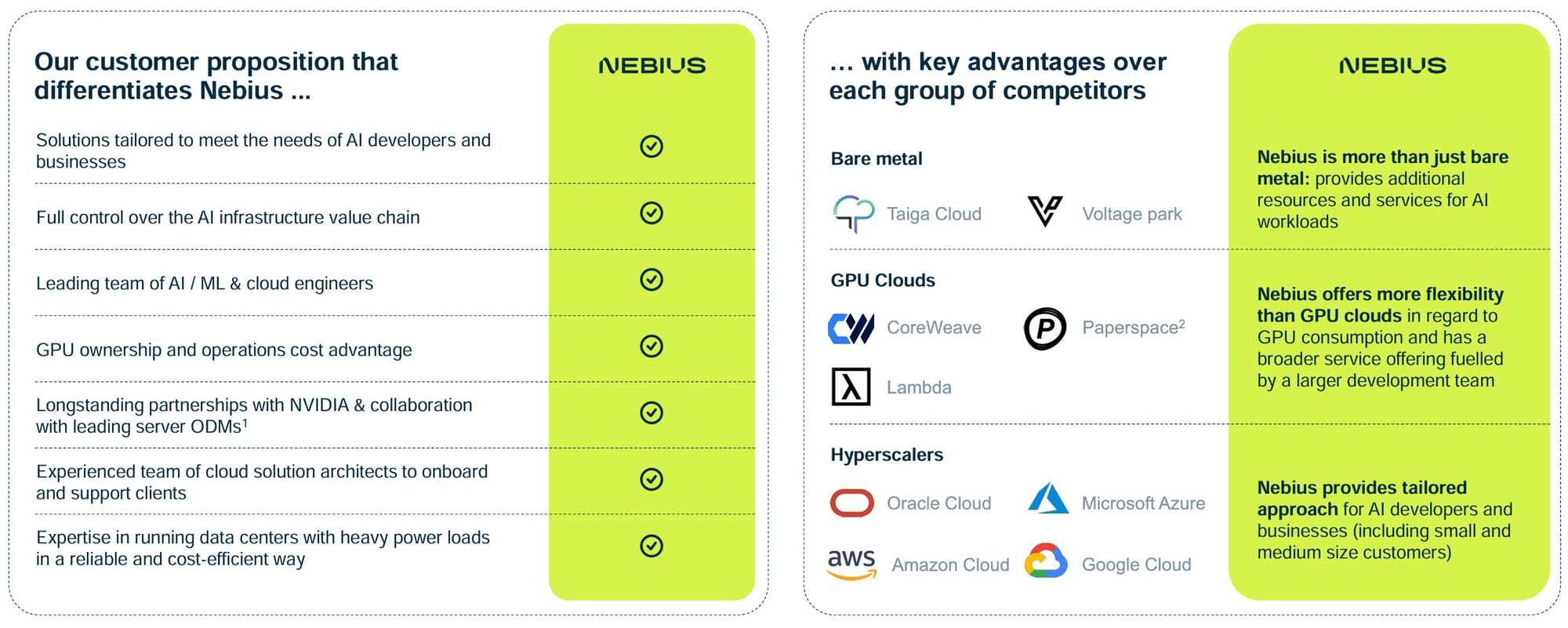

Nebius has positioned itself as an independent provider of AI computing and services. They point out that these infrastructure providers also have their own AI products and services business. They also control the decisions influencing their LLM offerings, which may counter the marketplace's needs and wants.

A critical aspect of the current LLM incumbents is much more important than a black George Washington. Much of the application growth in LLM-based systems and generative AI will be more domain-oriented and use-specific methods of training and inference. It's also likely that other AI methods will need to be added to work in concert with these methods to improve the accuracy and efficiency of inference.

I'm not saying we know Nebius will be cracking the code on all that. Still, it does mean that many companies will want to do their work on platforms that offer them complete openness and the flexibility to innovate independently.

The most direct comparable company is CoreWeave, which has a similar mission and capital resources. The layer between "infrastructure services" and "access to GPUs" is a blurry one right now and will take some time to sort out.

Parsing Reality vs Aspirations

Like a traditional IPO, Nebius tells a "big story" to inform investors about its future. That's all fair game. But before we go there, let's look more closely at what it has now and will have in the near term.

The data center in Finland is still small by hyperscaler standards, with only 14,000 GPUs deployed. Compare that to the recent xAI data center deployed with 100,000 GPUs. They have room to expand to at least 20,000 GPUs by the end of this quarter, which puts them on par with competitors like Voltage Park, which currently has 24,000 GPUs.

With $2B in cash and access to the capital markets, the company plans to expand the physical data center footprint in 2025 to reach 60,000 GPUs by year-end.

FWIW the company has "appointed Goldman Sachs as exclusive financial advisor to review [strategic] options and [accelerate] planned investments. Should we expect a glowing buy rating from them soon?

The company is growing fast from a small base. Revenue of ~$43M for the Sept 2024 Q is up $25M sequentially. ARR was $120M at the end of Q3 and the company expects to exit the year with ARR of ~$180M.

Revenue guidance for 2025 is believable at $500M ($400-600M) with an exiting ARR of $500M to $1B.

Estimates of positive adjusted EBITDA are for early 2025 with that year also being positive overall. This, along with potential "billions of annual revenue," is the aspirational part. [As a reminder, the entire industry has suspended thought around long-term operating margins and ROIC due to the "strategic" importance of the AI business.]

The Extras - Toloka, Avride and TripleTen

Nebius has subsidiary companies that add value to the story but also require capital investment to grow and reach profitability. In this way, they are a bit of a double-edged sword until we get better visibility.

It's also possible that Nebius will divest one or more of these and/or create a JV structure with a build-out partner.

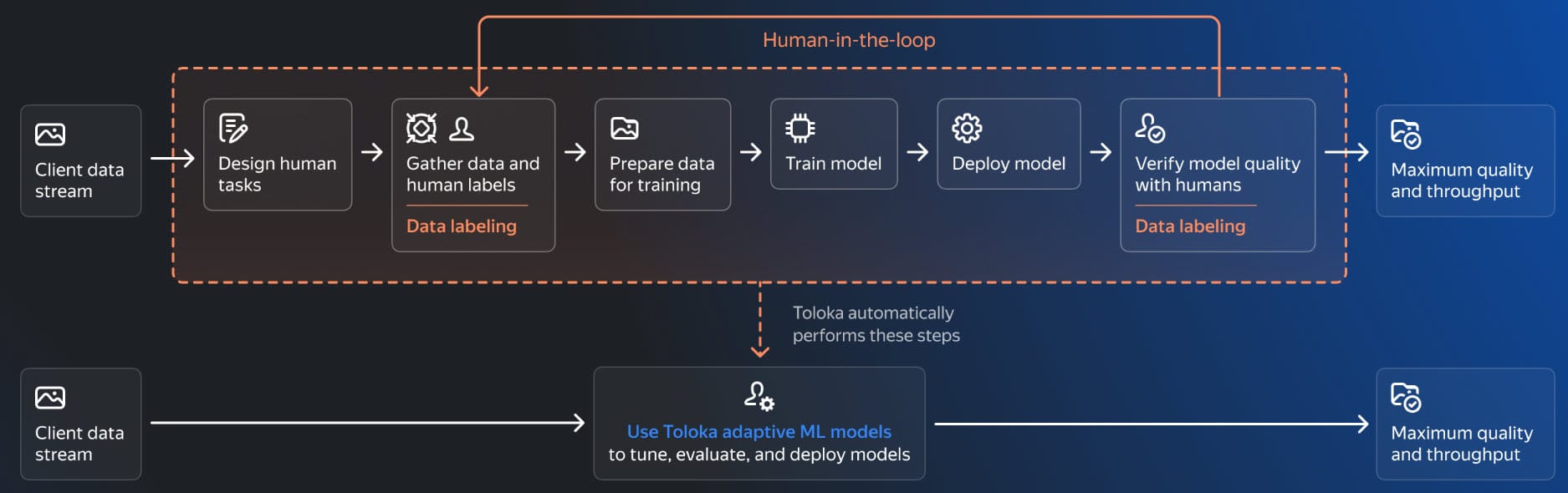

Toloka: Data sources have become a primary focus for training data. We've seen web scraping technology become mainstream, and content owners from Reddit $RDDT to the New York Times $NYT are all working to monetize their content to feed AI demands.

Toloka provides human data operations on top of AI data sources to fill the gaps and fine-tune prompts and models.

Nebius thinks Toloka can grow to $50-70M in revenue in 2025, which is reasonable based on what we have already seen from the scaping and content companies. If they can accomplish this, Toloka could be worth another $500M.

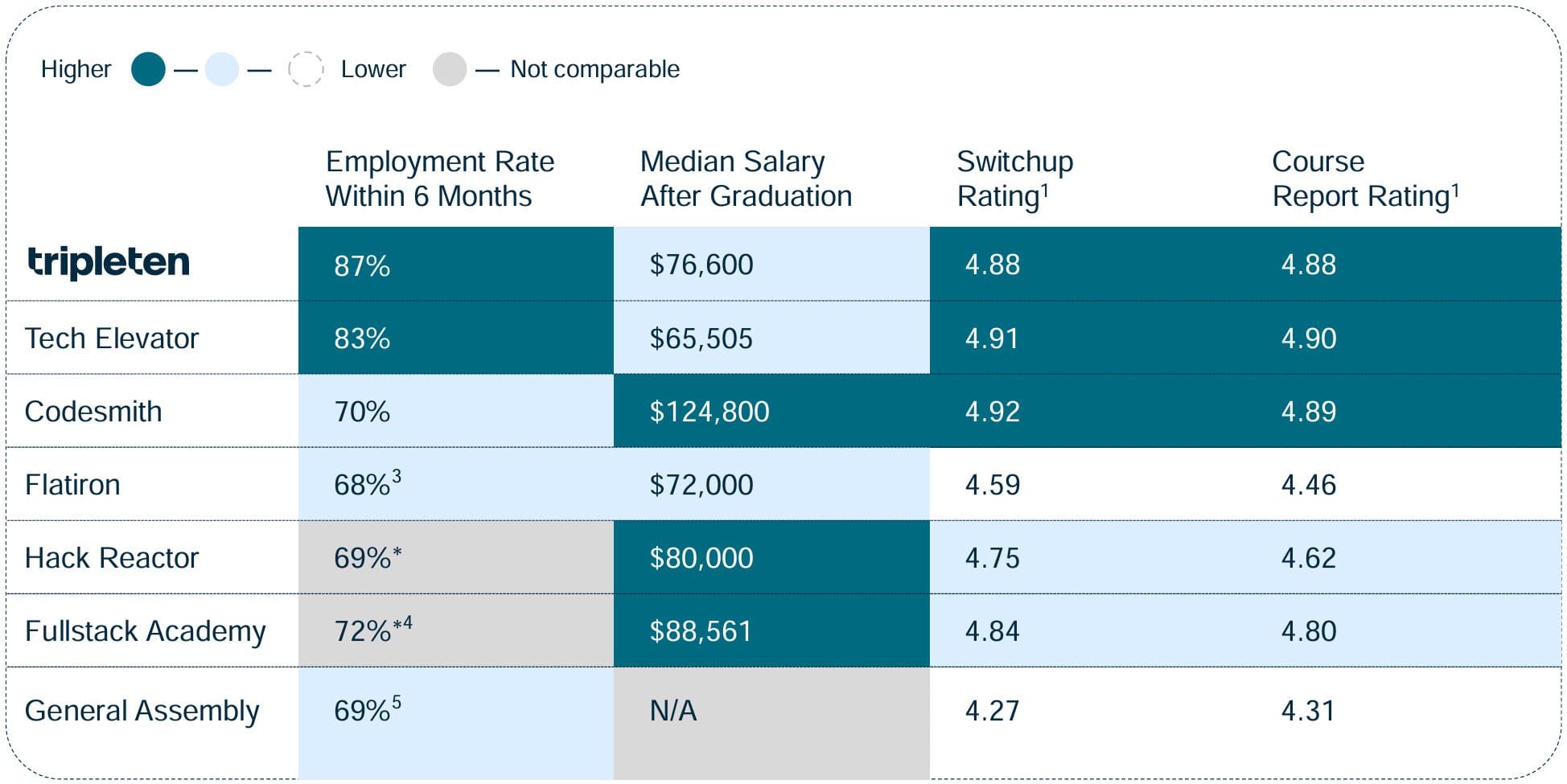

TripleTen is in the EdTech space, focusing on STEM and AI technology. This is already a crowded market, but some parts remain attractive. The higher-end platforms offer something more akin to private secondary education in a specific, in-demand vocation.

Investors are beginning to put value on some of these paid education platforms after shunning the larger-scale mass-market companies like Udemy $UDMY and Coursera $COUR. [That said, these companies still have $1B in market caps!]

TripleTen is a similar-scale business that could generate revenues of $40-60M in 2025. At this point, it is viewed as a low-value business, so it may not "move the needle" much for current shareholders.

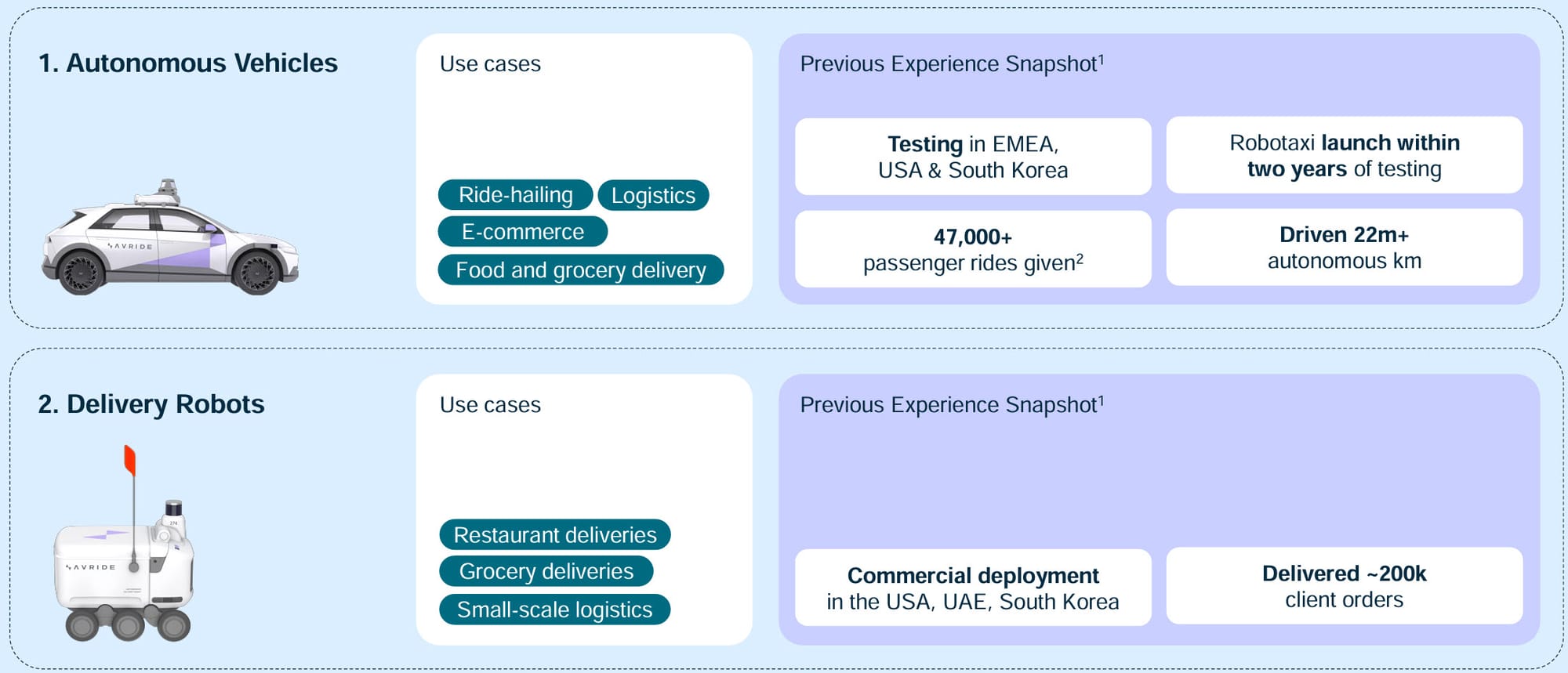

Avride is an autonomous driving startup in Austin, Texas, with over 200 developers. The industry has been a disappointing money pit for years, but eventually, use cases, and business models will create some winners.

I doubt it will be Avride, given the required scale of investment. The company needs $150M in funding for the next year to continue development.

But Avride could be a big wildcard. Look at Aurora $AUR, which recently raised close to $500M in equity and trades at a $10B valuation. Aurora is going after the self-driving market, which I always thought should be first - trucks. Driving is a long haul over straight roads with few distractions. ROI is much more material, given the rising labor and capital costs.

Despite Aurora's high valuation, I think the private markets will offer Nebius a much higher potential value for Avride. It could be material to the overall valuation if they can find an investing partner to fund development expenses next year or two.

One could add $500M of value to the parent company for these assets. I think funding and/or partnerships could add materially to this estimate. For example, if Avride did a strategic funding round of $200M, it could add $1B in additional value.

Stock Conclusion

With 200M shares outstanding, the current price of $18.50 puts the market value at $3.7B. Although the company had $2B in cash today, investors should expect all that to be rapidly re-invested in growing the business, so it's best to contemplate valuation based on 2025 and 2026 numbers.

If you prefer a giant shortcut and relative valuation, the reported most recent round for CoreWeave valued them at $19B, making $NBIS quite "cheap" using that yardstick. A hyper bull case on the shares could get the stock to $100. That kind of approach is not what we do here.

A more conventional valuation would use a reasonably direct comparable like DigitalOcean $DOCN. They have shown stable growth and profitability. The shares currently trade at 6x sales and 25-30x earnings. DigitalOcean has also been acquiring in the AI space with the recent deal to buy Paperspace.

Let's start with a revenue number of $500M for 2025, which is the midpoint of the current forecast. I'd say I can "see" the low end of $400M but not the high end of $600M. Putting a 6x multiple on the core business equates to $3B. Nebius will be growing much faster, so one can argue that 6x is too low.

I'd swag the rest at $500M today but could expand to $1B to $1.5B depending on partnerships.

That makes the current $18.50 share price a close reflection of fair value. There's some upside, though, as investors become more familiar with $NBIS and find additional financing and partnerships. The company has the cash, scale, and visibility to get some of these things done.

It's worth a small long as we see how they execute. The team at Yandex created a ton of value over the years we owned that stock, so I'm willing to give this team a chance at this price.

More to come post the ER next week.