Bob's $BOBS intends to price their IPO this week with a proposed range of $17-19. If it goes out there JPM and Morgan Stanley will have earned their money.

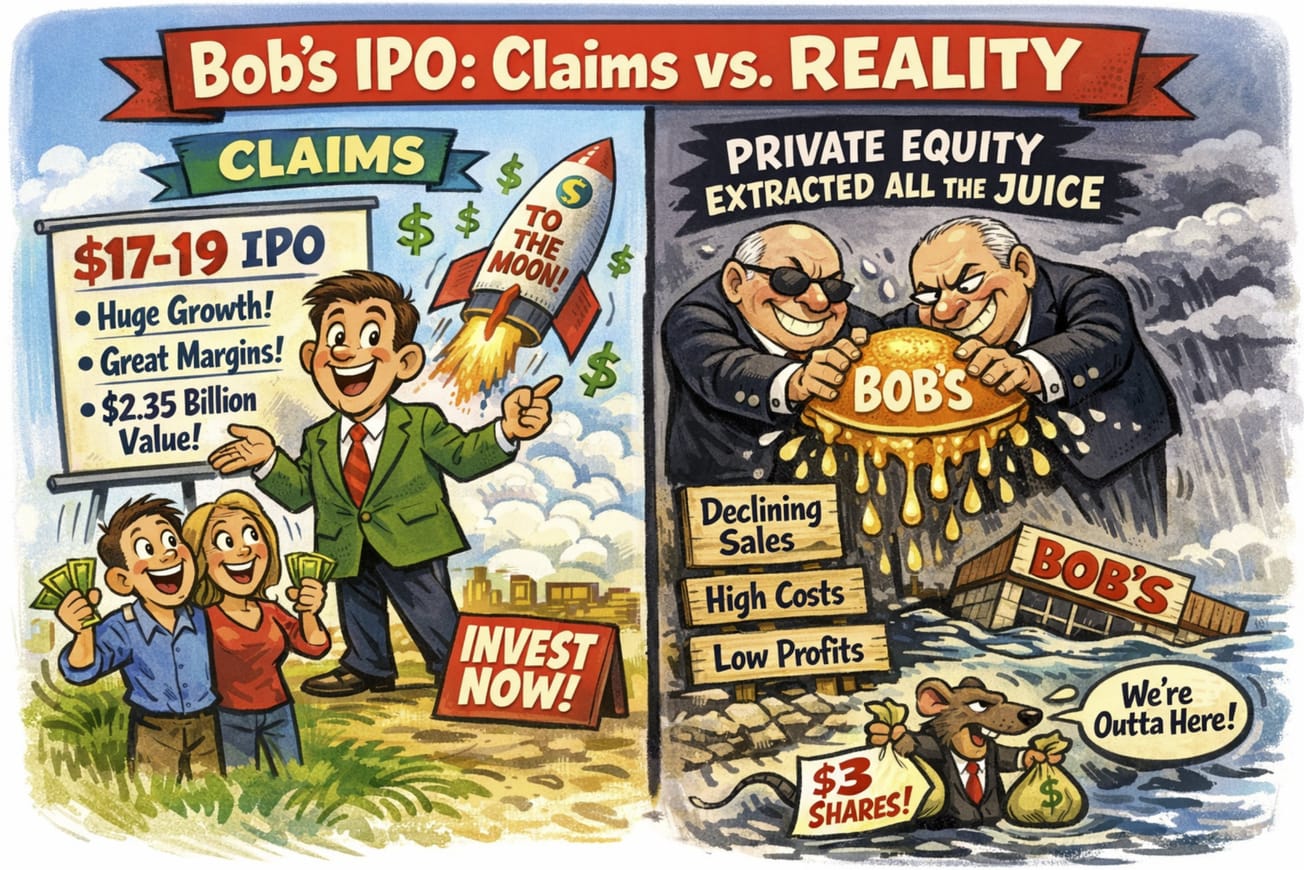

The offering has been dressed up to move after private equity has extracted all the "juice" and the proposed valuation is at least 50% above what anyone would consider fair value. It's a lousy business to begin with in terms of ROIC. Besides that customers don't like them and they have understated the actual costs in the business.

We've dealt with these "unmodeled" expenses before in this industry - notably when Wayfair $W came public back in 2014. Eventually they worked it out but it took some years. (Ref: Wayfair Battleground) Any investment analysis has to put them back in and that reduces the margins considerably.

Claims vs Reality

It's best to ignore the entire IPO roadshow deck which is pure eyewash.