But you might be surprised that we still had 96 IPO transactions complete, even in a lousy market year. The quality was low, though. More than half of the deals done are under a $50M market cap. Top and middle-tier banks left a vacuum in the calendar, which the lowest-tier banks filled with anything that might float.

There were also 102 SPAC IPO transactions completed, which we reviewed last week over at SPACvest. On average, those deals were even lower quality than the regular way IPO calendar.

But some very good names like Mobileye $MBLY had a strong debut in the market, and we were fortunate enough to identify it and find one of the few suitable IPO long investments of 2022.

There were also quite a few spinoffs and splits, which we will review next week. The split/spin trend will likely continue in 2023 because investment bankers and management teams need something to do to stay busy in a slow capital market cycle.

Even though we are not "out of the woods" in terms of higher rates, the economy, inflation, and a profits recession (at least), we are getting closer, and the market typically begins to trend up before fundamentals have made a clear turn.

Lower volatility in 2023 would support a better overall calendar with better-quality deals. Mobileye demonstrated that the right deal, in the right sector, with the right float and price, can be done in almost any market.

This note will provide an overview of the year and highlight some deals that might deserve more attention. A link to a PDF with all the deals sorted by categories is at the end. A values-only sheet can also be downloaded if you want to do some of your sifting and sorting. Contact me if you have YCharts and want the instrumented version of the sheet, and I'll send a link.

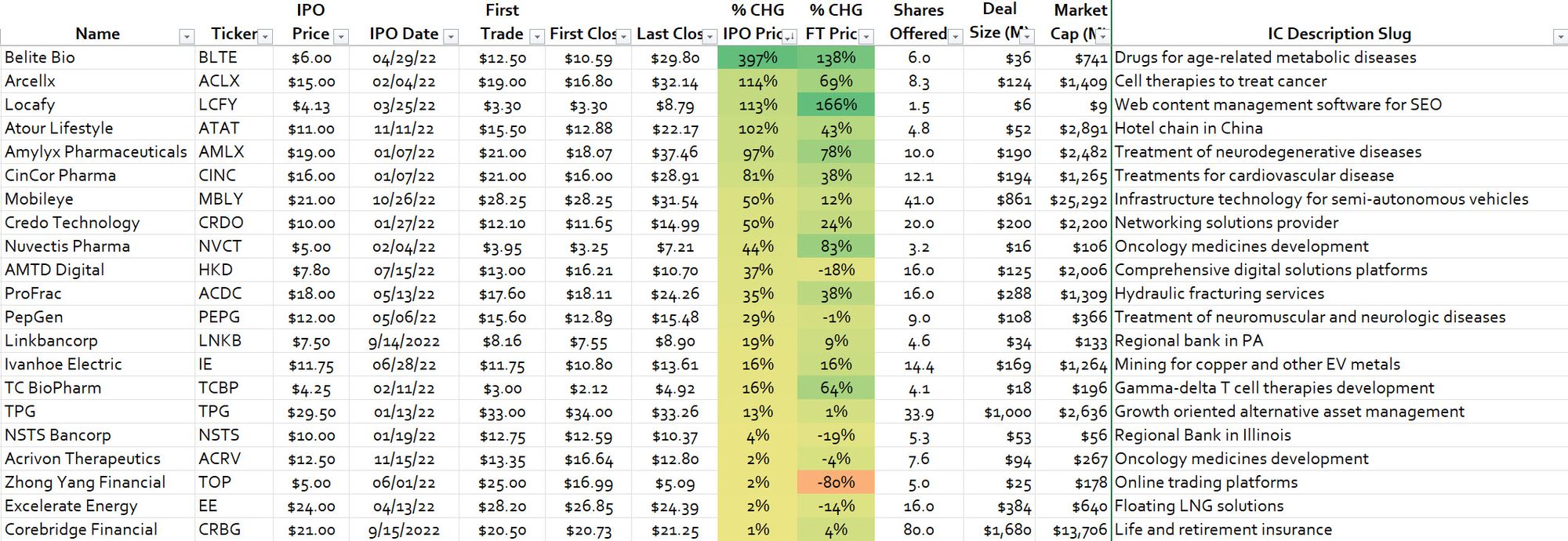

The Winners

Only 20% of the class of 2022 managed to stay above water. These are the top performers from the IPO price. In 2022 we saw some crazy "pop and drop" scenarios. Retail investors ganged up on small deals to send them up sharply post-pricing. The top performer has a drug in Phase 3 to treat Age-Related Macular Degeneration (AMD), a large potential market. Success is certainly plausible, but we avoid anything that depends on the outcome of a clinical trial. You can see the latest Belite $BLTE Investor Deck if interested.

The rest of the list is diverse and doesn't offer much in our wheelhouse. Mobileye $MBLY continues to be a good name for broad exposure to the "Smarter Cars" theme. There are some names to look at on the short side. See the video below on how to use the sheet to mine for some short gold.

Early Pivots

Some companies were hard to pin down to complete our review because they morphed into something new and changed their names and tickers.

CorpHousing Group $CHG came out as a corporate short-term apartment rental company but shifted into the hotel business and changed its name to LuxUrban Hotels $LUXH. I'm surprised, given how poorly other new names in this space have been doing. Sonder $SOND is trading at $1.30 (although I hear some of their properties are nice). I thought Vacasa $VCSA might have a chance since they have a strong position in some markets like Florida, but that one has dropped consistently from $8 to $1.75.

ProFrac Holdings $PFHC changed their ticker to $ACDC. My first thought was, "oh no, a fracking company is going into EV charging?!" But the company is just trying to draw attention to the idea that they are "more than just a fracking company" and are using M&A and investments to expand their footprint.

The business is still all about fracking, though, and recent acquisitions have been for more sand to push with their fracking fleet. As such, this stock remains a play directly tied to continued E&P for energy in the US basin areas like the Permian and Eagle Ford.

Shorts and Longs for Consideration

I went through the list with an eye toward the market cap, price/sales, cash balance, and quarterly cash flow generation. Check out the video below to see more about the process, but here are some salient points. As I write this, I don't have any positions, but I may initiate them as more work gets completed.

Short Bias - Ivanhoe Electric $IE is a mining company eager to get associated with "EV metals" and enjoy a high valuation. It's got a $1B+ market value and is burning cash. I'm also looking at Piedmont Lithium $PLL.

Short Bias - AMTD Digital $HKT is a meme stock that was boosted to crazy highs post the IPO. It's down but still sports over a $2B market cap and very little revenue.

Short Bias - Applied Blockchain $APLD looks like it may become insolvent even if BTC prices are stable. I'll need to dig into the financial statements to be sure.

Short Bias - Credo Technology $CRDO is a networking company trading at 20x sales while burning considerable cash. They look like a higher-end supplier to the very competitive data center market.

Short Bias - Atour Lifestyle $ATAT is an upscale hotel brand in China. The reopening will probably lead to strong growth for the company, but it's already trading at over 8x revenues. I wouldn't want to walk in front of a China reopening play right now, but I will do some more work on it.

Long Bias - Reborn Coffee $REBN appears to generate cash and has a tiny market cap. It depends on what the P&L looks like and how much cash they have. Coffee is pretty resilient in a recession.

Long Bias - Yoshiharu $YOSH is a ramen noodle restaurant operator. If we have a recession and times get bad, we may eat more ramen noodles. Another tiny market cap, but if they are generating cash and able to grow in 2023, it could be a good name.

Long Bias - Nobody thinks Genius Group $GNS will succeed in education serving the entrepreneur niche. Trading at 1x revenue and generating cash. Worth a look.

Long Bias - Treasure Global $TGL is an online payments outfit serving Indonesia. If the number is correct, it looks compelling. We'll need to dig in. Indonesia has huge potential. It could be an add if management is solid and they are cash flow positive.

Long Bias - FGI Industries $FGI makes kitchen and bath components in the repair and remodel segment, with some sales going to new construction. Investors avoid housing-related, but the shares are trading at book value with a 6x P/E. Sales are falling pretty hard YoY, so there is no rush here.

Full Documents and Video

You can download a PDF with the full list with full company descriptions and various sorted lists - by performance, sector, and market cap. A "values only" version of the sheet can also be downloaded to play with and make your own.

Here is a short video posted on our YouTube channel to illustrate some steps and observations when looking at potential shorts or longs from the list.