The consensus on $MBLY is that it's being set up to "pop" thanks to a low float and commitments to buy a large portion of the IPO by the CEO and other investors. Its $18-20 range puts the market value at ~$15B which is what Intel $INTC paid for the company back in 2017! They will still own a majority of the shares so it sets them up well for future sales at higher prices. (It also represents a bit of an "overhang" IMO.)

The deal is scheduled to price Tuesday night and trade Wednesday, October 26th. Even in this market, it's pretty low risks at this price given the float and valuation.

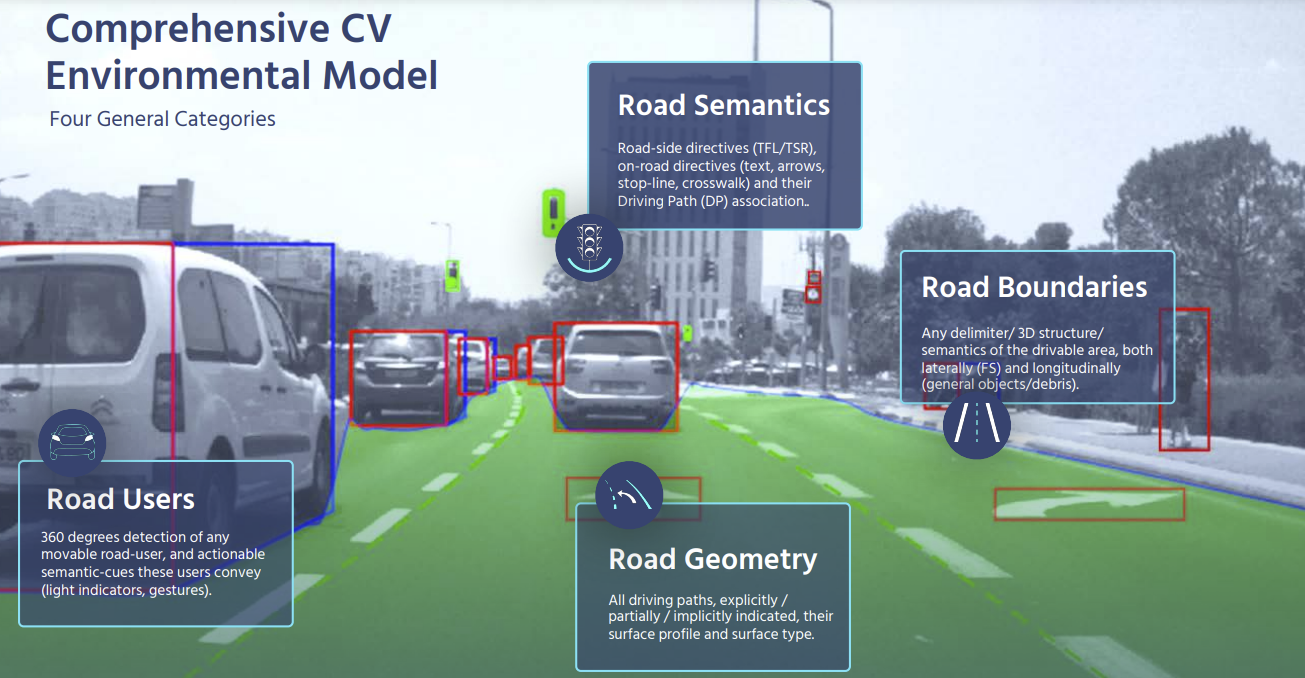

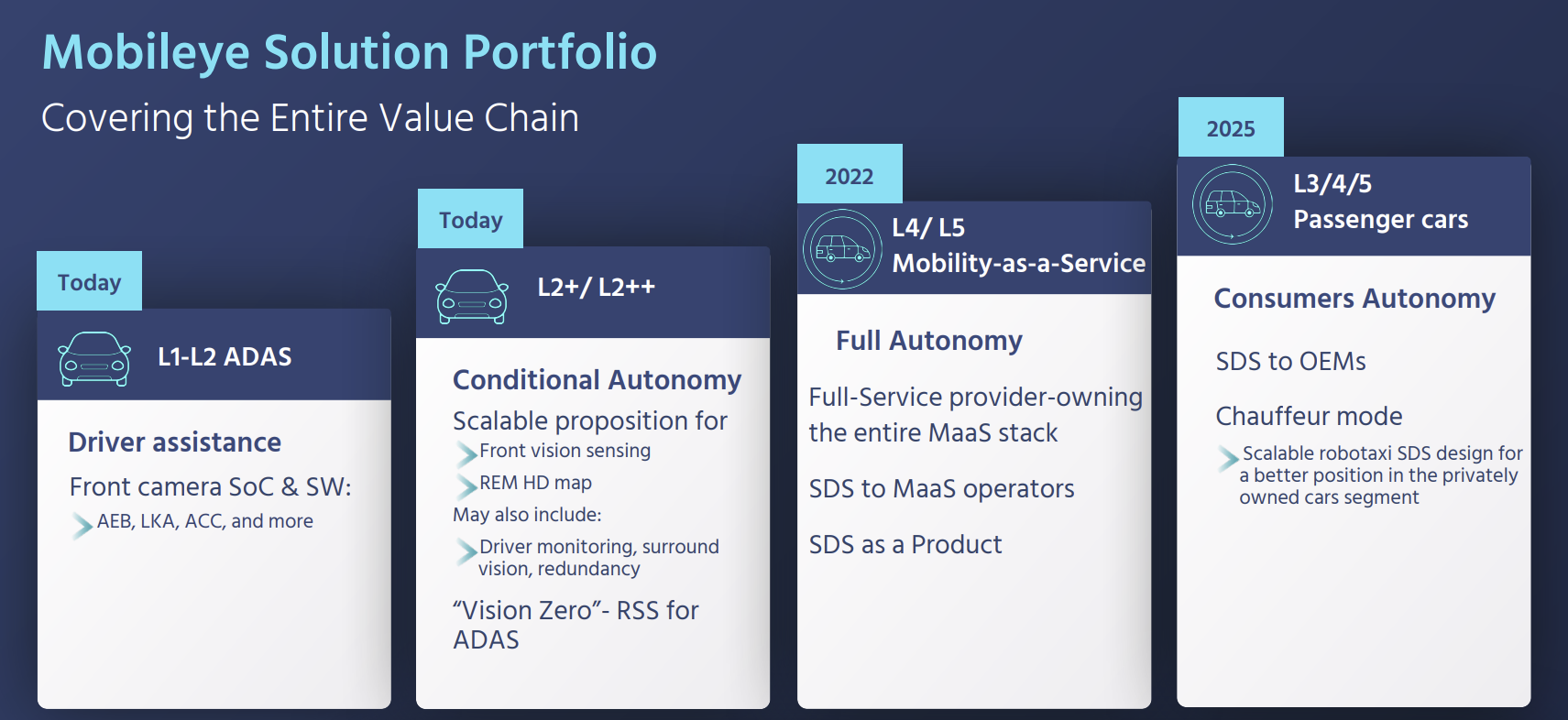

Mobileye is close to what one would consider the "standard provider" of ADAS components to the big auto OEMs. They offer a very broad range of solutions and a roadmap that allows makers to customize the level of ADAS they want to offer in each model.

Mobileye has also invested more in understanding and providing solutions that revolve around increasing safety that will serve them well as the industry (along with regulators and consumers) take small steps towards higher levels of driver assistance and "self-driving."

While Mobileye faces competitive risks from "in-house" developments at OEMs and suppliers they are likely to retain a significant and leading market share in the ADAS components and systems market.

Mobileye Intel Divorce?

The strangeness around the relationship with Intel has not been addressed. STMicro $STM is a partner doing design, packaging, and testing for Mobileye. Like many STM uses Taiwan Semi $TSM for fabrication. STM effectively is doing all the back-end design and manufacturing. Where is Intel?

As a stockholder, Intel will be maintaining control but it looks and feels like Mobileye wants to be free. Intel can sell plenty more stock post this offering and still own just over 80% which they may be tempted to do.

It's hard to see what the long-term play is here for Intel. They have done very little in terms of building deep working relationships with Mobileye as a semiconductor manufacturer.

$INTC stock is getting a nice bounce this week after hitting a 20-year low recently. If $MBLY really takes off there may be some follow-through into the

Float Trumps Valuation

If we were just looking at near-term fundamentals and comps the shares would probably get a 5x multiple of $2B in sales or around $10B. But the low float and investor excitement mean there's a good chance to see an upside from the current range.

For institutions, $MBLY stock is a big opportunity for them to boost Q4 performance in what has been a terrible market for most of them. A limited float means they can mark the price up all the way to year-end.

It's not the right comp but if you use NVidia $NVDA at 10x sales we get to a $20B market cap and a $25 share price.

Above $25 could certainly happen if all the players decide to make it so. Intel is at $112B now ($27.42/share) and may continue to benefit this week if $MBLY holds above the offer price.

I'm long some $INTC into the pricing and may buy some $MBLY shares in the open market depending on how things shape up Wednesday morning.

The final reason to be long some $MBLY is that if investors see the stock as a primary way to play the trends toward AV and EV then the stock can be outside of normal valuation parameters for a long time. We experienced that with $TSLA for quite a while before reality set in there.