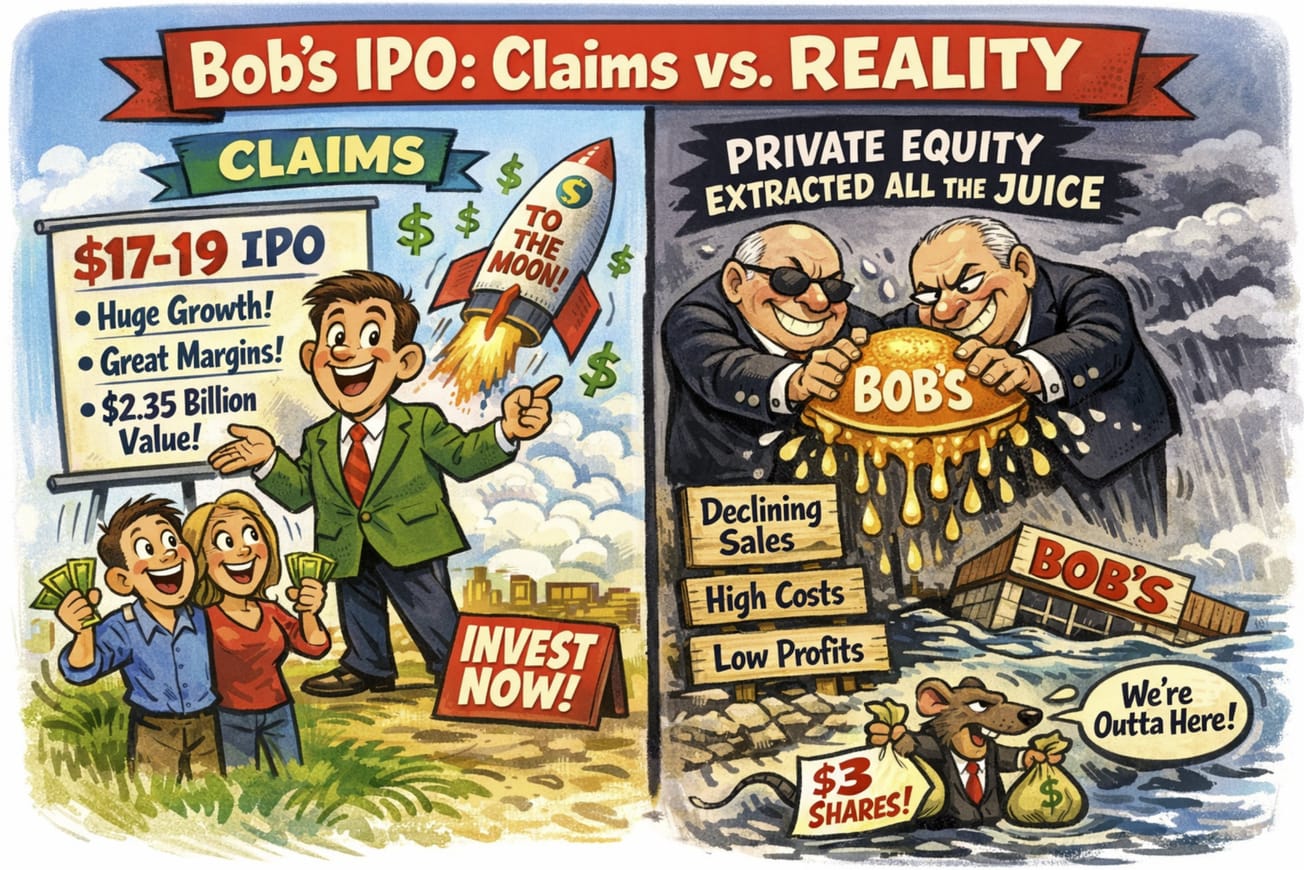

There are a few detractors out there regarding the upcoming Figma $FIG IPO but the only short-term question is "how high will it go?" This comes after Adobe $ADBE failed to buy Figma due to (seemingly valid) concerns from the FTC and a $1B cash breakup fee paid to Figma in 2023.

Back then Adobe was willing to pay $20B for the company with another $3B allocated to Figma employees post-deal. Investors don't have a hard time doing the math - if FIG was worth $23B three years ago and is valued at a mere $16B at the current filing range it's a slam dunk!

That presumes that the next few years for Figma are going to look like the past few. As we discuss below nothing could be further from the truth. The company promises that "they will be even better" but an equally valid case can be made for "they are going to be much harder."

I'm not going to pretend that my valuation model (DFV) is going to be useful here but FWIW a very cursory run through the model gets me to $34-40 using very rosy assumptions. That compares to the current filing range of $25-28.

In this market what has worked much better is a right-brained process that goes along the lines of "given what they do and their market position what should this be worth?" An early example of this working very well was Reddit $RDDT which I missed due to thinking about it in terms of fundamentals.

In order for the right-brained approach to work Figma must become a clear category leader like the names shown in our SaaS leadership group below. If they can the thinking goes something like this: Names like Shopify $SHOP, Adobe $ADBE, Crowdstrike $CRWD and Snowflake $SNOW are worth between $72B to $166B.

Using this kind of thinking the crowd arrives at something along the lines of "well then Figma could trade for 1/2 of that range or $35B to $80B. If you take it at $60B then you get $100/share or about 60x sales. This just a very blurry waypoint on where things might go.

Let's look at what Figma will be up against. The next phase will hinge on sales execution, commercialization of a raft of new products, and dealing with much more competition in development and deployment.

The Design-Driven Platform of Record

Adobe is the incumbent leader in design software and for most companies and designers it has been the "system of record" for decades. Adobe saw the challenge Figma presented and hoped to nip it in the bud but now they must contend with the upstart.

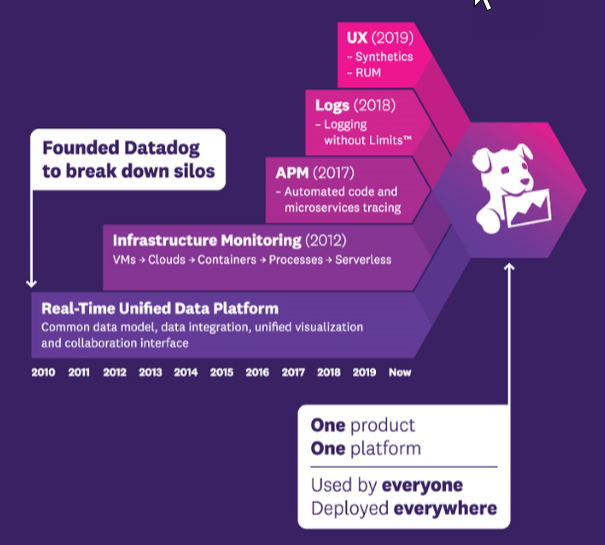

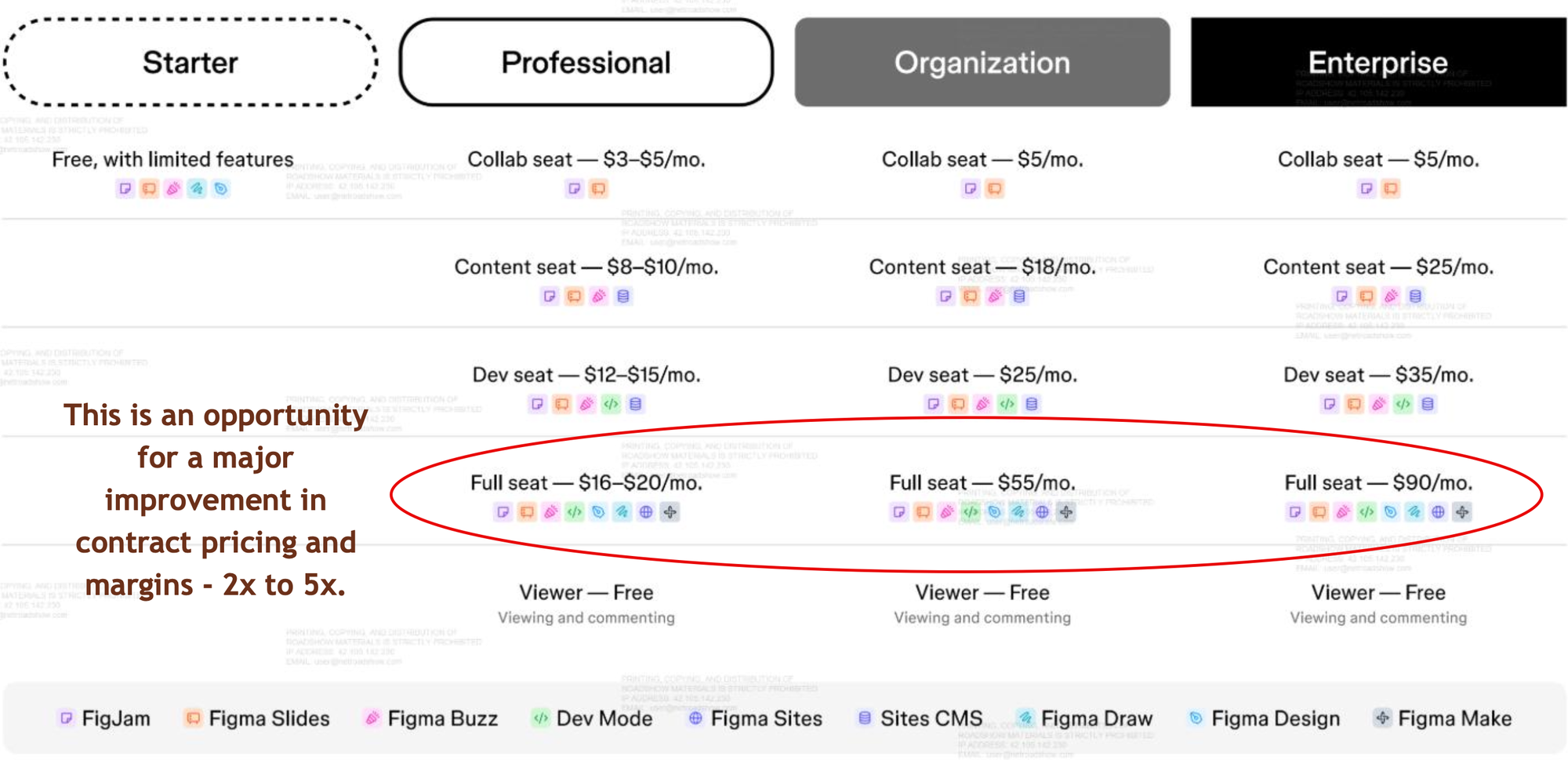

More importantly the upstart must now contend with being a "full solution provider" and has launched a suite of additional products that promise to take the company solution well past "design" and into building full applications (like Claude Code and Cursor do) and support shipping and deployment. Figma acknowledges that their success will likely involve key partnerships in these areas but the market remains fluid.

Industry consensus is that Figma has a powerful advantage in collaborative design and product development workflows. They also have a technological platform lead when users demand more browser-based, flow-oriented tasks rather than "heavy duty" desktop operations.

Figma has been investing their $1B settlement windfall to add a host of new products this year. Most of these are still in beta and it will take some months before we know how they will stack up to other solutions.

This is a high stakes moment for Figma because at this point they will need to start funding R&D from operations. Consider that Adobe generates nearly $8B of free cash flow which is 10x Figma total revenue.

If these 2025 product launches are successful investors could see an acceleration of growth at Figma. That's the number one thing to watch for as we get into 2026.

We will have a market of coexistence with Adobe continuing to be the dominant platform - similar to a Microsoft in the enterprise context. With Adobe out of the running who might acquire Figma longer term of what direction might Figma go in terms of M&A?

One of the most intriguing combinations to me is with Amplitude $AMPL. Figma shines in the product development management space but lacks any methods to measure user behavior. The combination would be a potent upgrade for both companies. For more see our previous "Retro Candy" note on Amplitude.

If any bankers are paying attention I'd note that AMPL is trading at a a paltry $1.4B in EV and would be very accretive to a post-IPO FIG. The real "hidden asset" there is the sales motion and process at AMPL which has undergone a major upgrade and has the momentum with very large enterprises that Figma needs to sell the new product suite.

Nobody Cares About Numbers But...

Yes I'm going to bring up stock-based compensation here. In the last two years SBC was ~$1B per year! This for a company with revenues well under $1B.

Since investors refuse to care about SBC one can't blame companies for exploiting it and reporting positive "Adjusted EBITDA" and using it for all valuation computations as if the SBC has no impact.

Just for fun if you factor in SBC as an ongoing high expense the DFV note above drops from $34-40/share to $22-27. It matters!

After the "quiet period" ends post the IPO we will get ratings with price targets from the analysts. They are still beholden to a process that requires them to have some link between valuation and stock price.

Some will go through the pains of a DCF analysis which is less effective than our DFV process still widely used. Most will highlight P/S on 2026 and 2027 sales and a few may include a "normalized P/E" on 2027.

Expect to see revenue estimates of $1B for 2025 and $1.5B in 2026. One has to consider PLTR to be an outlier which suggests a range of 15-30x P/S. If we use 2025 that gets us to $22B to $45B or a share price of $36 to $75.

There's no P/E number that supports a higher price so DCF will be the only method that can be massaged to produce a higher number.