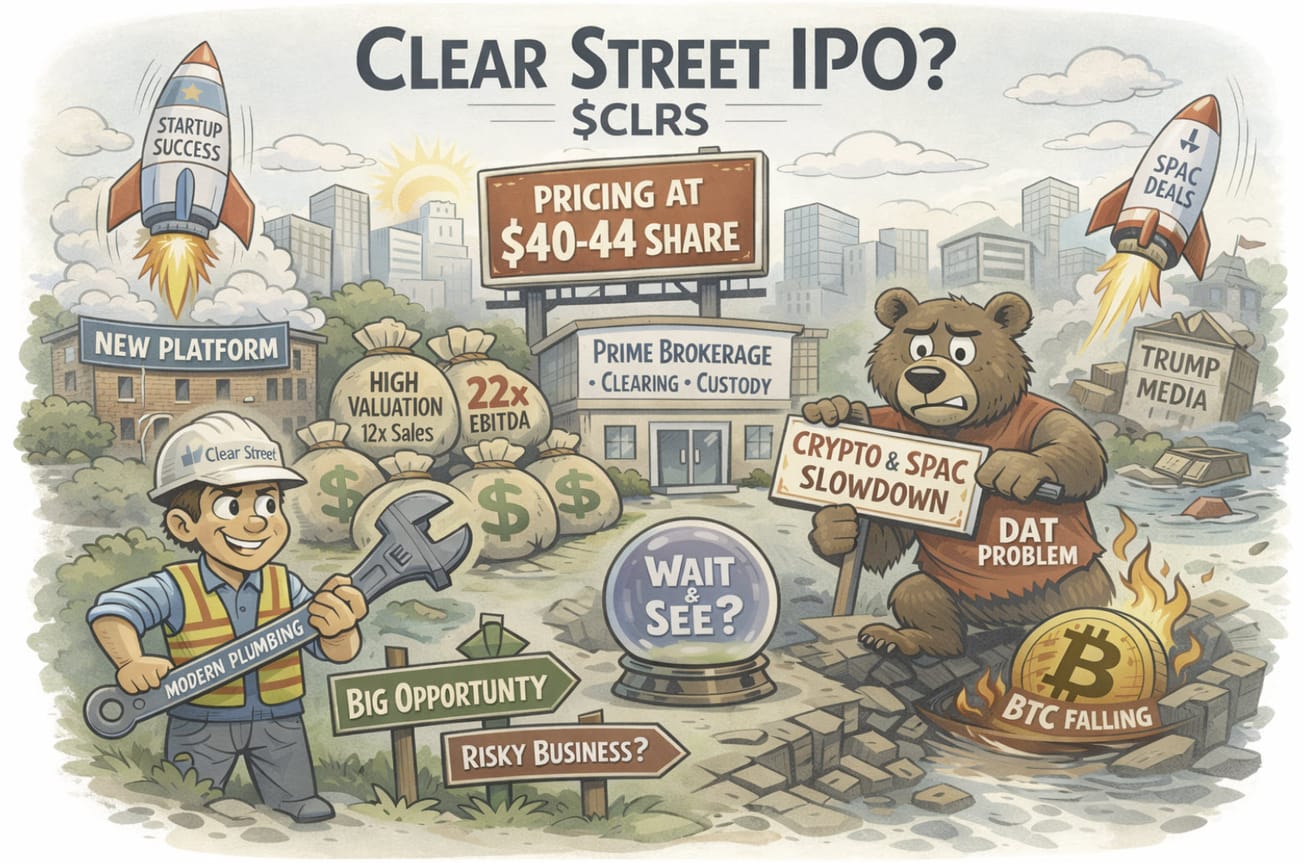

Clear Street $CLRS is scheduled to price tomorrow to raise ~$1B in the range of $40-44/share. That puts the market value around 12x sales and over 25x Adjusted EBITDA. There are some reasons to wait on this one.

The company was founded in 2018 as a cloud-native, end-to-end capital markets platform built on a single real-time ledger. It provides prime brokerage, clearing, custody, execution (including proprietary algorithms), risk management, and financing services across equities, options, futures, security-based swaps, FX, fixed income, and select digital assets.

They have followed the classic "disruptor path" by starting at the low end of the market (emerging hedge fund managers and smaller funds being abandoned by bulge-bracket banks due to legacy cost structures), offers a technologically superior but initially less-scaled product, and is moving upmarket over time.

The established platforms are generally still running on older technology and it's been some time since anyone has built a new platform from the ground up. For example Interactive Brokers is considered technology forward but was founded in 1978! All these were born long before "single ledger" was possible.

Clear Street at $1B in revenue is still a very small player in a large market, they put the "SAM" at $128B. They have grown rapidly and are clearly taking share from large established players running older infrastructure and middle-market players (think BMO, Wedbush, Cowen/TD) that are well behind the curve.

Institutions appreciate the scale opportunity in this business. Related companies have large market values - Schwab $180B, Robinhood $78B, Interactive Brokers $34B, Tradeweb $27B. They also enjoy high EBITDA multiples of 20-30x.

The investment landscape is shifting with more "democratized access" via companies like Robinhood $HOOD but also SoFi $SOFI, Coinbase $COIN and prediction markets. It's easy to slot Clear Street as the "modern plumbing provider" of this new investment landscape.

I'm generally a fan of these models and we have investments in a few including Virtu $VIRT. Miami International Holdings $MIAX was a very good position for us which was recently sold after the post-IPO run.