Even though it's only a small part of what we do with our coverage, there are times when a "coverage swing" trade is a piece of low-hanging fruit we like to pick.

There have been a few cases (as with the InMode $INMD IPO back in 2019) where gains can be large; most of the time, these are small but worthwhile, given their short time frame.

We published our note: Nextracker Makes a Sunny Debut in Mid-February after the IPO. Our analysis suggested a price target of $44-53, giving us the first part of a decent setup for a coverage swing trade with the shares ~$30.

The Setup

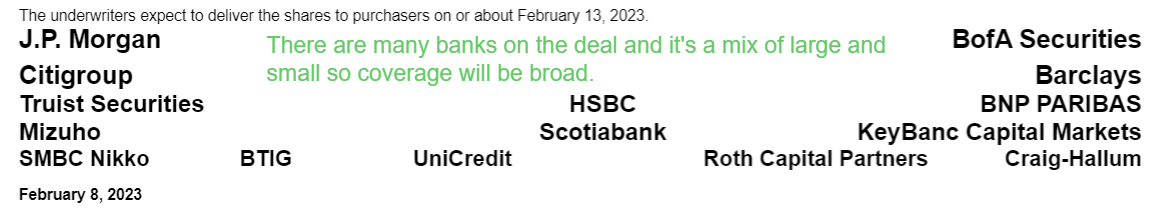

The best candidates for this type of trade have at least a dozen firms on the cover of the prospectus. That way, you know that when the coverage date comes, plenty of noise and attention will be given to the shares.

In determining how attractive the trade might be (and hence position size), I consider the thematic appeal, management quality, growth and margin trends, liquidity, and competitive position. Finally, I compare the share price to my own estimate of what analysts will likely see as fair value for price targets.

Sometimes some "technical factors" like initial float relative to demand come into play as they did with Mobileye $MBLY. Every situation is a little different.

Nextracker $NXT checked a lot of boxes here. Solar is perhaps our favorite theme in renewable energy; the management team and produce offering is top-notch, and our estimate suggested a 50% potential upside.

Playing with AVWAP

During this time, Brian Shannon published his new book about using Anchored VWAP, and there's even a section on IPO trading (see pp 181-190.) We are not technical traders here, but Brian is an outstanding professional trader who cuts through what I see as lots of "clutter" in looking at stock price action.

There is as much art as there is science in using AVWAP and especially in terms of "setting the anchor point," but in the case of an IPO like NXT, you can try using the high-volume opening trade, which is what we did. (You can see the heavy blue line in the chart.)

Even though my own plan was to simply wait for coverage to sell into a more active trader might have been able to enjoy multiple exits and reentries given the stock action we experienced.

Closing the Trade

Although coverage was launched today (Monday, March 6th), the shares were up big on Friday in anticipation of the event.

In such cases, I like to stay disciplined with the execution plan. I sold 1/2 on Friday for a nice gain and the balance today at similar prices.

In round numbers, the return was a bit over a 10% gain over a period of less than one month, which is quite good on an annualized basis.

It would have been consistent with the strategy to have added to the position at the beginning of last week since the shares were still close to my original purchase price, but I was very busy and didn't monitor it closely enough. (As I said, we have many other things to do!)

Why not keep some, given the shares are $34 relative to my price target of $44? That's a different question for a different timeframe and portfolio. There were some risks noted in the write-up that are valid. The stock will remain on our close-watch list and in the renewable energy theme so that it might get revisited.

As with all content on this site, this is not investment advice and is for educational purposes only. Please read all our terms and disclosures for more details.