Last week both PACS $PACS and UL Solutions $ULS had successful transactions in what was a choppy market. We covered these last week: A Peek at PACS and UL Solutions. Of the two we will be inclined to follow ULS.

Today we had coverage of two recent deals from the banks. Reddit $RDDT got price targets clustered around $50 and Astera Labs $ALAB a more enthusiastic $85. (It's interesting how so many analysts come up with such homogeneous price targets.)

FWIW, I think it's early to have conviction over the Reddit content licensing model beyond 2024, and I'd say the same for Astera Labs vis a vis high bandwidth connectivity. In both cases we have seen evidence to the contrary.

This week, we have CPG marketing platform Ibotta $IBTA, which is proposing a $450M IPO at $76-84, and Centuri $CTRI, which is doing a regular IPO but is a spinout of Southern Gas.

We'll have notes out on those two. They are at quite opposite ends of the growth and risk spectrum. Centuri is more interesting today due to the pressure on utilities to upgrade and modernize their electrical grids in the face of rising demand and creaky infrastructure.

Even though we have a "no clinical stage cancer drug" policy the NeOnc Technologies deal is interesting in that it is at least novel and nobody seems to be paying attention. We have a brief on that to share this week too.

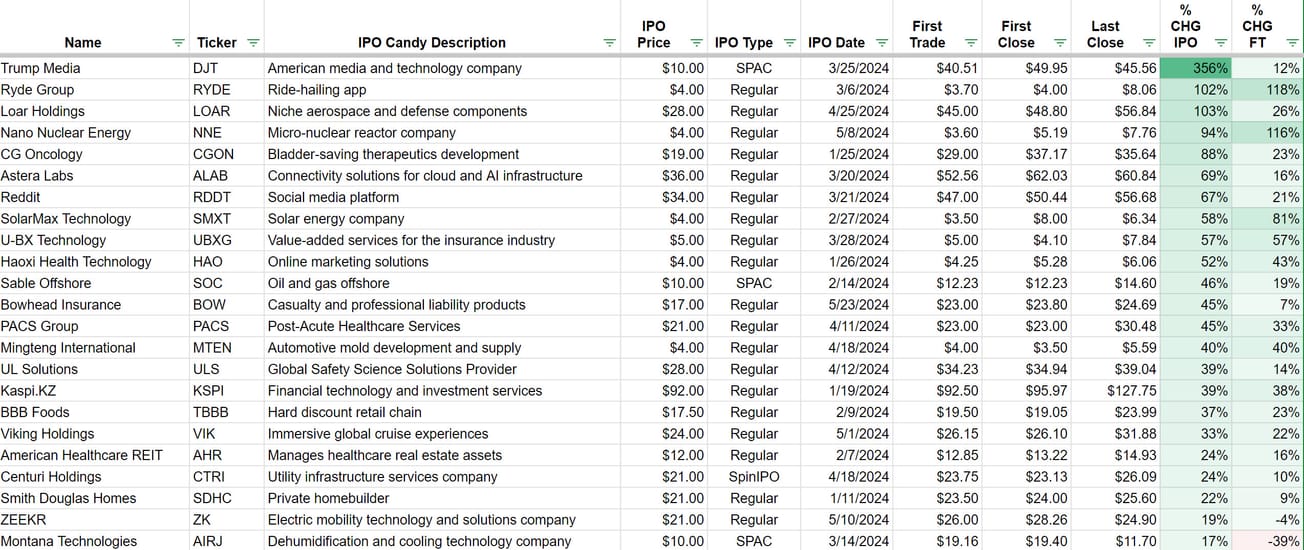

YTD Performance

It's been a pretty good year so far albeit with light volumes. These are just the regular-way transactions and some were quite small.

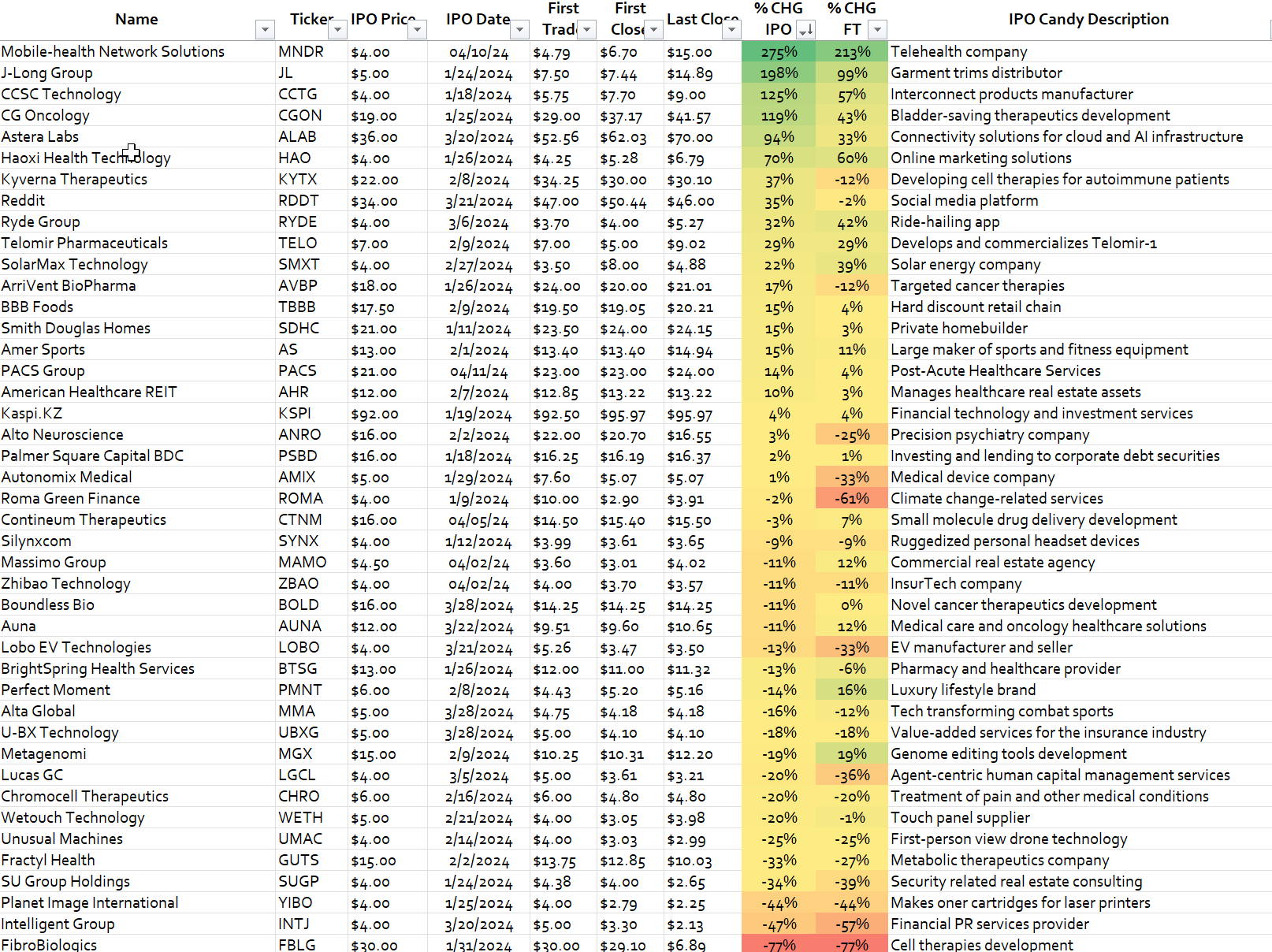

In addition to some more coverage of these deals we'll have an update on the "Broken Candy" portfolio.