PE firms have earned a reputation for buying a company, loading it with debt, paying themselves (and their limited partners) fat fees, and then "transforming" the company with layoffs, divestments, and financial engineering before finally dumping it somewhere once all the "juice" is squeezed out of it.

Not exactly inspiring stuff! That's an exaggeration perhaps but they are mostly about making money.

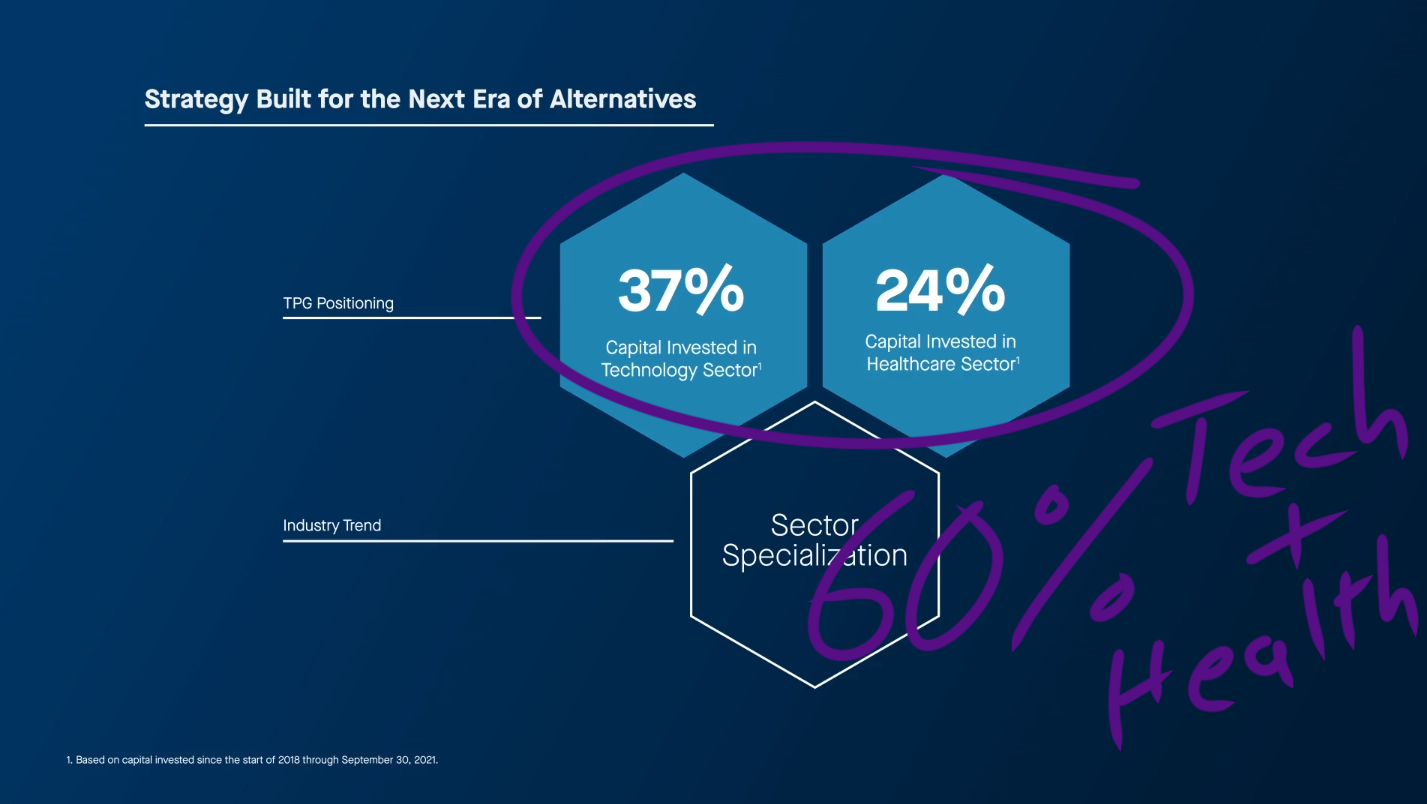

TPG $TPG is planning their $1B IPO next week and positioning themselves as a PE player that is differentiated due to their focus on growth industries like technology and healthcare, and being able to launch large innovative products like their impact-oriented RISE fund with assets in the billions. At the mid-point of the current $28-31 range that puts the market cap at $9.4B and the EV at $7.7B.

It's been a great year for public PE firms. Blackstone $BX has doubled in the last 12 months and other big players like Carlyle $CG and KKR $KKR have done similarly.

I'm going to skip some of the more boring stuff which includes myriad financial metrics that make them look good relative to other players. But there are some attractive elements of their business strategy for growth-oriented investors that would like to have less volatility than $ARK.

Cathie Wood $ARK is all about investing in innovation but her investment approach and portfolio is more like a collection of call options than traditional investing. This is not meant to be a criticism it just is what it is. When she thinks about assets and returns hers are based on valuing factors like innovation that will not show up in the P&L for a long time.

TPG has been investing heavily in more growth-oriented businesses and has 60% going into that sector. Names in that portfolio include Spotify $SPOT, AirBnB $ABNB, C3.ai $AI, Uber $UBER and ZScaler $ZS. This is a natural outgrowth of the shift of private companies going public later in their development and taking later-stage expansion capital from firms like TPG.

They leverage partnerships well with large companies like Intel $INTC and Humana $HUM have enabled them to make sizable and lower risk investments in technology and healthcare. Other PE firms do this as well but they are more transactional about it. With TPG you don't feel like you need to take a shower after doing a deal with them.

These "complex carve-outs" are fertile ground for finding low-risk, larger-scale investments in growth businesses.

The Inside Information Edge

PE firms like TPG have a substantial advantage over general public market investors, even large institutions because they have a wealth of inside information. If the general public know how big the internal advantages were for PE firms they would be awed. The information comes from the fact that the company has a mix of investment and operating executives deployed among companies across multiple industries and business types.

So how does this work in practice? The examples I know from working with other PE firms tend to involve deep knowledge of portfolio companies to inform investments in related companies, competitors, or vertical adjacencies. So let's say a PE firm is very active in the retail sector and they know that several of the portfolio companies are signing new lease agreements around a new development in the Washington DC area because Amazon is set to build a large HQ operation in the area. They can share that with the real estate side of the business who can take action on the knowledge that demand and pricing in that area are going to go up in the next several years.

None of this is meant to be specific but you get the idea. The ability to make connections between portfolio companies is standard practice as well. Large VC firms typically advertise this as one of the benefits of taking their capital. However, PE firms have an even bigger advantage here because they have a much broader set of investment types and sectors.

Even a single managing partner at TPG has the opportunity to create relationships (and also spur potential M&A) within their own sphere of activity. This is just made up I don't suggest these companies should or are working together on any projects.

When you combine this the ability to "connect the dots" across an entire PE network is uniquely informative and provides an ongoing information advantage for them.

RISE and RISE Climate

The launch of the RISE fund is a case study of how TPG is more thoughtful and hip than traditional PE firms. They engaged with thought leaders like Bono, Branson, Reid Hoffman, Pierre Omidyar, Lynne Benioff, and other luminaries to build a positioning of "this is the one" even before they launched. The result is a dramatically more efficient fundraising process and broader participation across LP types.

Maya Chorengl is a real asset and has put together a good team. An important point to make around ESG and other "impact" investing is that for it to really work and create change there have to be strong investment returns.

TPG RISE was launched and quickly became the largest PE impact fund in the market. Subsequent raises including RISE Climate get them to over $13B in AUM and leadership in this high-growth new market.

If you're at a cocktail party and someone introduced themselves as being "with a PE firm" the general response is to go get a refill or make a trip to the bathroom. At least TPG has managed to engage some non-boring people as part of their effort.

This approach also gave them a large amount of free marketing edge that directly translates into greater efficiency in raising capital.

Love it or hate it this is a huge growth area in terms of AUM and fee generation.

Stock Conclusion

Old-timers look at this and suggest that a TPG IPO "marks the top of the PE market" and public market investors are being offered stock only because the insiders think the timing is good and perhaps the "easy money" has been made.

As a smaller and more efficient PE firm with much more surface area in growth businesses, I think TPG can grow faster than the industry - effectively gaining share versus other, more traditional players.

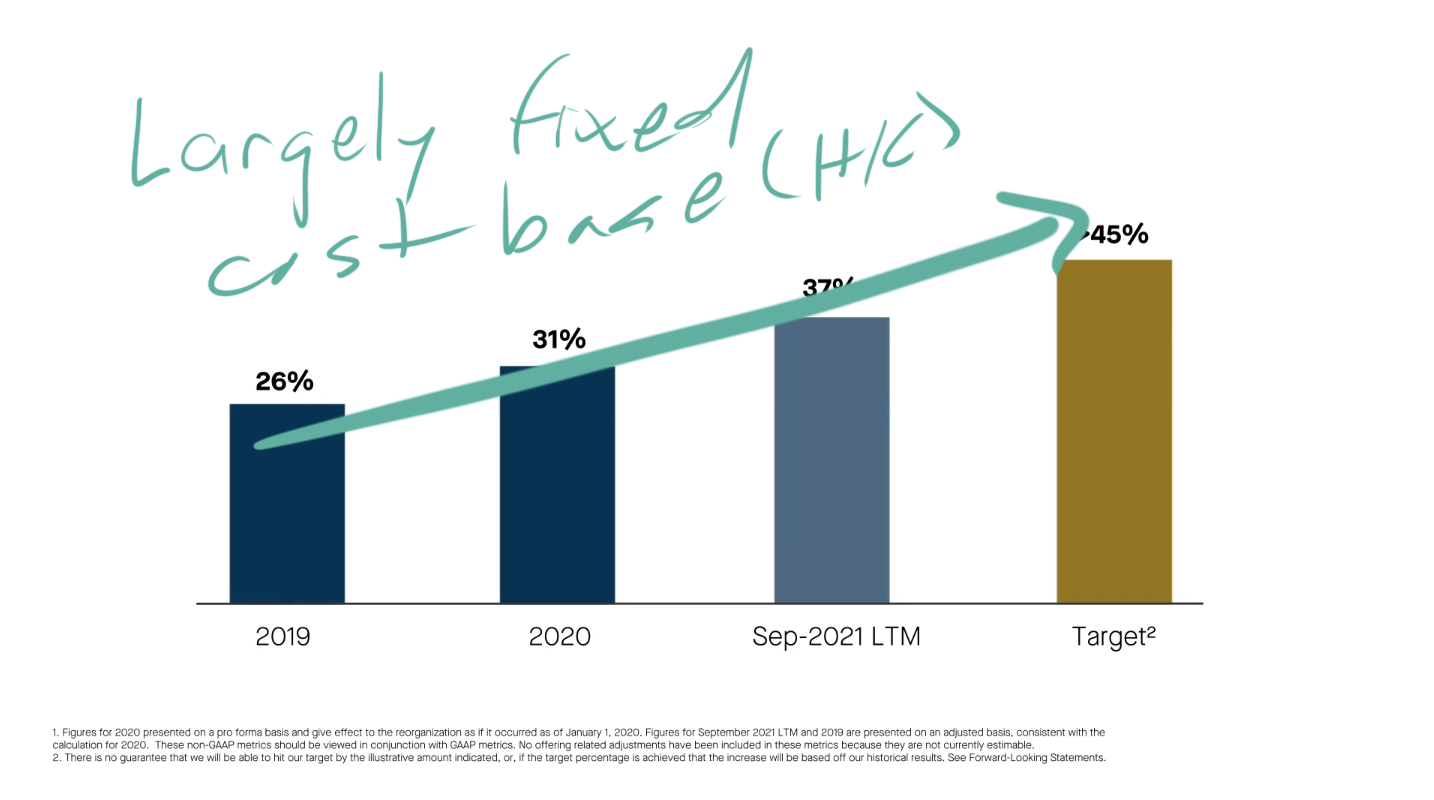

TPG is in a position to continue to enjoy "increasing returns to staff and process" which is due to the fact that the increase in capital and fee-generating investments can largely be done with existing staff. It's a high fixed-cost model so as they grow their margins are likely to expand.

One area we can't predict is how they might use their new "public currency" to expand into other areas. They have been explicit about it and noted the areas below. I'm not sure if these are incrementally more or less attractive than the core business. Given their current profitability, it's not clear expanding into these areas will be good for investors.

Valuing PE firms seems challenging because the standard deviation of just about any metric you chose is very large. That said these stocks have all performed well over the last few years. Due to their informational advantages noted above and our current market structure, I expect these firms and their stocks are likely to perform well.

| EV | AUM | ROE | ||

| Blackrock | BLK | $135B | $9,464B | 16% |

| KKR | KKR | $111B | $460B | 42% |

| Carlyle Group | CG | $25B | $293B | 81% |

| Apollo | APO | $34B | $481B | 151% |

| Blackstone | BX | $98B | $731B | 68% |

| Ares | ARES | $24B | $282B | 30% |

Wide-Ranging Figures Characterize the PE public stocks.

For comparison, TPG has AUM of $109B versus the EV of $7.7B. The real question for investors is do you think that TPG will make good on their plans to grow into a top-tier firm like the ones listed above. And if they do it how long will it take? Is there anything in their model that suggests they would get a premium valuation relative to other PE firms in the market?

At first glance, the $7.7B seems to be fair if you compare it to Carlyle Group and Ares. If you apply the same EV/AUM ratio as CG and ARES you get an EV of $9.3B. That would suggest a share price of $35 versus the proposed $28-31 range. Not super-exciting unless this choppy market provides a lower entry price.