Another name in our Micro Cap Candy series for your consideration. After watching Vox Royalty for nearly two years, I decided this deserves coverage and ownership.

This unique little company has figured out how to leverage software and data to build a profitable business in precious metals royalties.

You can get exposure to precious metals with built-in growth and dividends at a substantial discount to NAV, given the current $2.30 share price.

There's little analyst coverage. $VOXR only has a $100M market cap, but the fundamentals are strong, and insiders have major ownership.

Mining Investors Drive Royalty Stocks

I've known plenty of precious metal investors over the years. Jim Grant, for one, and his whole network of clients and friends. Some very smart people have been in the space for a long time, and I always enjoy listening to their stories.

A PM that has been investing in precious metal miners for decades spoke at a Grant's conference a little over a year ago. He stated that "mining companies generally have the worst management teams you will come across in any industry." I don't know if this is fair or true, but he is a professional.

Mining companies and producers are by nature "asset heavy" and can go from profitable to loss-making in a heartbeat (and vice versa) due to their high fixed costs. So these are not great businesses to invest in.

If you're worried about inflation or currency debasement, you can own precious metals physically. You can also own an ETF like $BAR, a share of a vault filled with gold bars and trades close to NAV.

The problem is these assets just sit there. There are plenty of other ways to hedge and other assets that not only keep pace with inflation but can generate income at the same time.

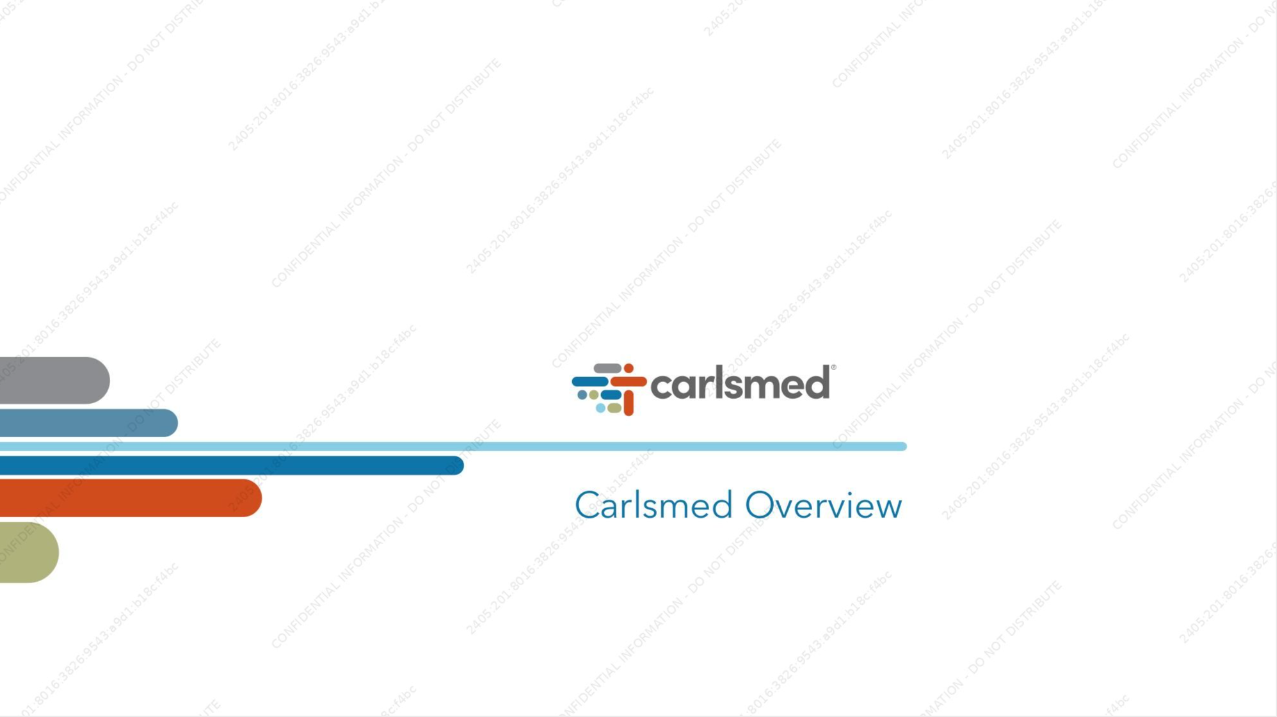

In mining stocks, the innovation that investors have loved is instead of owning mines and producers own a company that collects royalties instead. These have the advantage of not being asset-heavy, growing with production, and benefiting from rising prices.

This has spawned a universe of these royalty stocks led by names like Royal Gold $RGLD, Wheaton Precious Metals $WPM, and Franco-Nevada $FNV. These three dominate, although there is another handful of midsize players like Sandstorm $SAND and Osisko $OS. These companies comprise about 95% of the sector's market cap of around $50B.

At least a dozen small public companies are fighting for the scraps the big players leave behind, but they don't have any particular competitive advantage. That means they can grow their business but must compete directly with others doing the same thing, which lowers prospective returns.

Vox Royalty has been increasing revenues and earnings, but the stock has not reflected their progress.

Their growth will continue, so our future value analysis below is a better indicator of what the longer-term upside is.

Mine the Data, not the Dirt

In round numbers, the size of the global mining industry is $1T, with an asset value higher than $1T. Thousands of small royalty agreements fall between the cracks within this giant byzantine industry. In some cases, the owners don't even know about them because they acquired them through some other acquisition or they are not material or related to their core business.

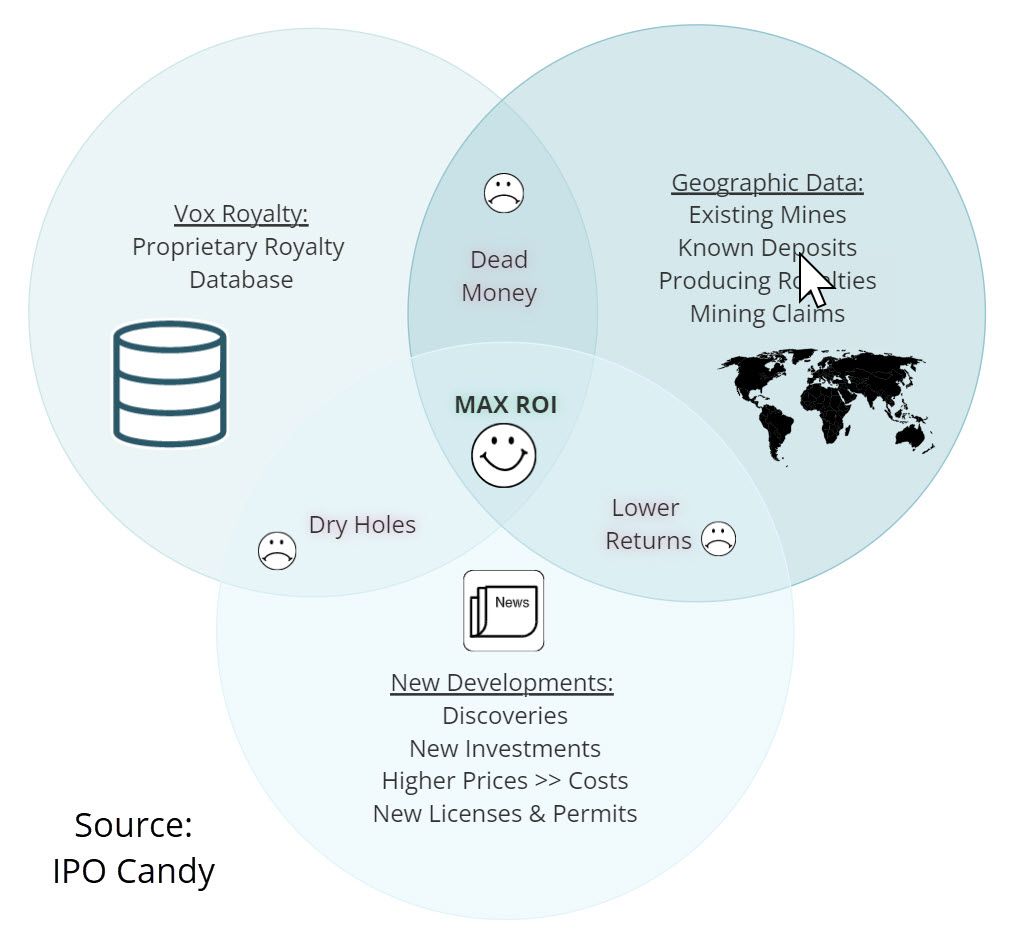

In 2019 Vox Royalty acquired a Mineral Royalties Online online database. This gives Vox a potent information advantage. These are also generally much smaller and illiquid, so they can often be purchased at a favorable price relative to market rates. Vox quotes the size of this dataset as over 8,500.

The other major data set is around the property itself. The first layer of property data is static - existing royalties, known mineral deposits, and mining claims. This static data helps guide the search by geography and specific property areas.

Even the most promising properties are inactive, and their ability to generate increasing royalties is unknown. That's where the next layer of more active data comes into play. Monitoring overall industry activity makes it possible to isolate and prioritize changing areas. Royalties become more valuable when there is a catalyst to unlock value in the underlying asset. For example:

- A major discovery increases the production capacity, expands the viable mining area, and extends the mine life.

- Higher commodity prices lead to a mine with strong production reopening and able to be cashflow positive right away.

- A new capital investment program increases and extends the production of an existing mine - generating higher royalty payments.

The magic happens when you join these datasets to find little-known royalty agreements in the most lucrative areas likely to experience positive catalysts.