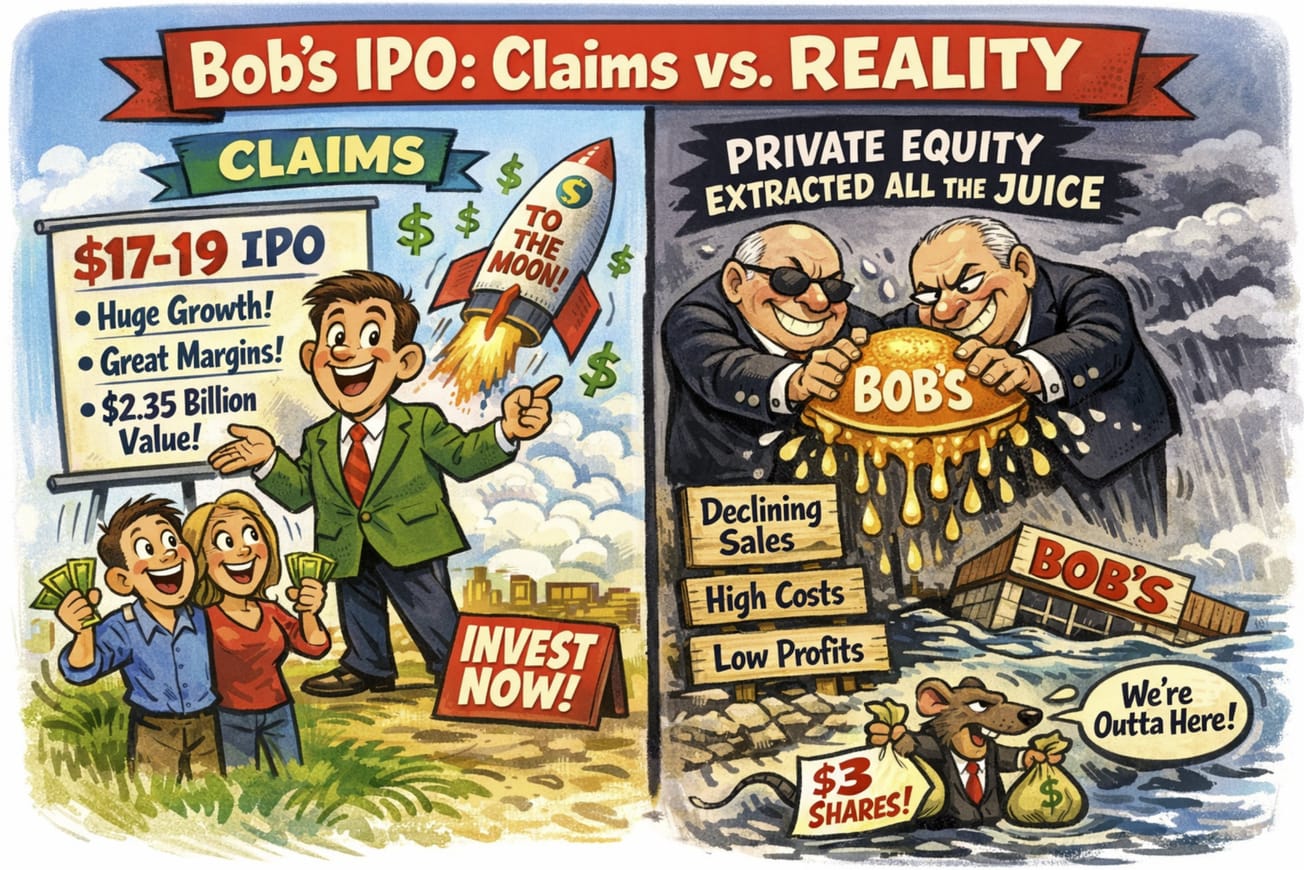

It was easy to get into Playboy $PLBY on the de-SPAC back in 2021. It was also easy to get out with nice gains since it was obvious to anyone that cared to follow their "expansion strategy" that every single effort was either an abject operational failure or a dilutive expansion that devalued brand equity rather than expand it.

In 2021 we had our worries but they had a $280M business growing 40% with a path to profitability. We thought they might be able to generate as much as $100M in EBITDA back then. The shares enjoyed a $1.6B market value back then.

We fully exited the stock by 2022 when the operational cracks were evident and the "strategy" went completely off the rails.

You might enjoy revisiting our prior posts on it: here and here. There is some comedic value in the history that works on a Friday. Rabbitars?! Cardi B?! LOL.

The list of failures includes a decision to shift from high margin licensing revenue to attempting operational ownership instead, rampant expansion with acquisitions of Honey Birdette, Yandy, and Lovers Stores and adding debt. Instead of expanding profits the D2C segment lost $207M on an operating basis in 2022.

The "investment case" today is pretty simple - we're going to reverse all the things we did over the past few years to restore the value the company once had. It's a bit hard to get excited about this since this is the same management team responsible for the poor execution and ill-fated strategic moves in the past.

The company did do a life-saving deal with a large private company called Byborg which provides some downside protection in the form of a steady long-term licensing revenue stream and a likely buyer if things to off the rails again.

Management has driven down the fundamentals so far that they have at least given themselves and possibly the gift of "easy compares" as they regain some level of stability. Like most I believe that even at this stage the brand can be worth $1B or more in value, but question why investors are still stuck with the same leadership that broke the company in the first place. The greedy thought comes from in part from recent successes like Victoria's Secret $VSCO that abandoned their "woke" detour into plus sizes and went back to their aspirational focus to get back to better results. Most people have sex with the lights off.

In this revisit I'll take a look at the current positives, the neutrals/concerns, the really big challenge and finally an investment conclusion and some considerations around the best way to get after it.