In October 2022, we did a little educational post called "Warrant Diving" on how to sift through all the pre-deal SPAC warrants looking for the ones that might pay off.

Our search led us to one name that stood out above the rest. We settled on Compute Health Acquisition $CPUH as our target out of hundreds of SPAC warrants. It's taken many months, but we got the news we were looking for this week. And the warrants responded nicely!

This is the second part of this case study, and there will be a third after the company completes the de-SPAC and we see how it performs.

I did sell some warrants between 9c and 10c to reduce my risk on the position to almost nothing while I waited. A few more were sold into the strength on the announcement day to book some profits. At the same time, I added a few common shares and options to the mix just in case the small float attracts retail interest.

Compute Health $CPUH Announces Allurion Deal.

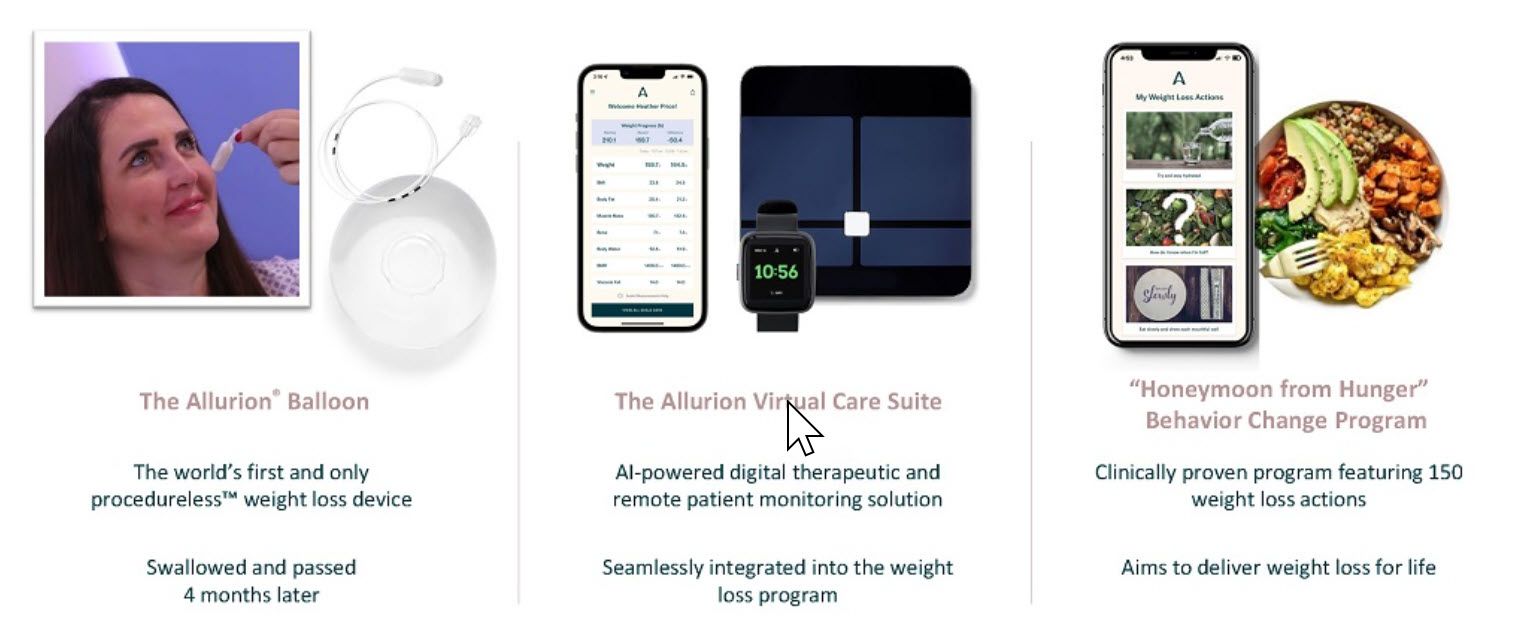

Allurion is targeting the obesity problem, which is massive and growing. That makes it a large global market opportunity. What looks promising about the solution is the combination of 1) an actual medical intervention, 2) monitoring and engagement through a virtual care suite, and 3) tools aimed at behavior modification to make the effects more durable.

Specifically, the solution is based on a balloon that can be swallowed (with some discomfort, no doubt) and is "passed" some four months later. The patient is also given a weight loss program to follow, professionally monitored and tools to help them change their behavior.

The pro-forma valuation is ~$500M, and expected 2022 revenues are $64M. The treatment is approved in 50 countries, mainly Europe, Latin America, and the Middle East. The big market, the US, won't come until after 2023.

For more details on the company, we posted the Allurion Investor Deck.

Next Steps

The deal will move towards final approval and the de-SPAC now, which the company expects to complete in the second quarter of 2023.

During an extension meeting in December 2022, most shareholders exercised their rights to redeem shares. This reduced the public common shares of the SPAC from 86M to 9.2M shares, so the current float is only ~$100M.

Allurion can benefit from simultaneous growth drivers - expansion in the existing markets and the addition of countries in 2023 and 2024.

The US FDA trial is underway, and one would expect solid results based on other trials, but any clinical trial result carries some risk.

There are competitive non-invasive gastric balloons, so additional research is in order. Allurion does have a substantial amount of IP, positive momentum, and an attractive business model, which gives them a solid position.

I'll be working on "Part 3" of this case study, preparing us for the de-SPAC with the IPO investment case.

There tends to be quite a bit of volatility around de-SPAC moments, so we want to be prepared for that.