I never published the "First Look" that I wrote about three months ago. The window has been extended to July 22, 2023 and there are 856,042 shares remaining that have not been redeemed.

I've included the original First Look below. I didn't like it then and it didn't improve with age. Here are the call outs:

- The M&A angle of growth is a negative. Investors tolerated this strategy better when the market robust but have retreated from these types of companies. Not only did they form the current company with M&A, they plan to continue it.

- There's a big focus on the "huge TAM" and the "huge and growing SAM" in the deck with them noting that their SAM is already $73B and will grow to $149B in 2026. This for a company with no revenues.

- Showing lots of "possible customers" on a slide mixed with the few relationships they do have is a red flag for me. This is an investment and not "story time."

- The management teams of both the company and the SPAC appear to have some real knowledge and experience but they were assembled on the promise that this would be a quick success. That's no longer the case.

We'll see if this one makes it out. If it does it could be a good short out of the box although you have to be careful with these tiny float companies. The short positions and put option prices are often so high you wonder about taking the other side!

Perhaps we'll see an updated deck with more evidence of traction, revenue and backlog before they try and float in the market.

The Original First Look

This is another "fabless 5G semiconductor" company. They are hoping to come public via the Chavant Capital $CLAY SPAC. There is little left in the SPAC as most shares are already redeemed. Only about 1M shares are left outstanding, and the promote is 2M shares. There are still 6M SPAC warrants outstanding.

Here are the puts and takes based on the first review of the public info:

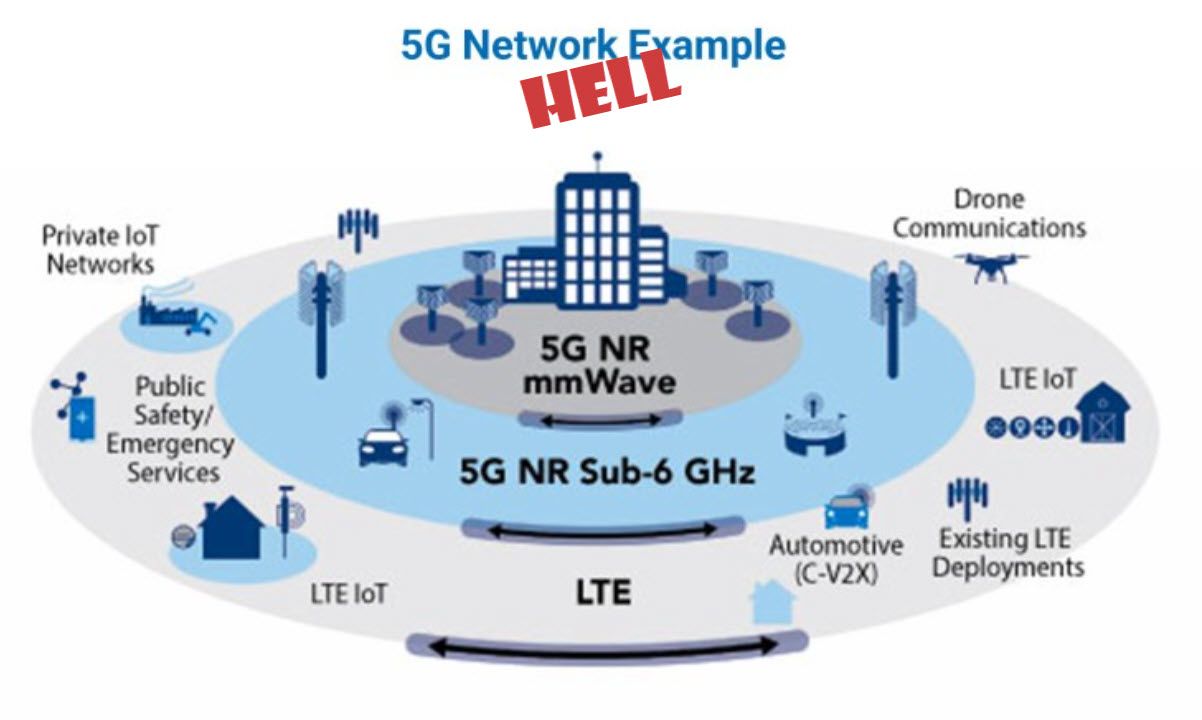

- It's two businesses - wireless and optical interfaces.

- The wireless side is based on a slightly simpler 5G technology that offers lower-cost, more performant solutions. They may have advantages here, but it's a hyper-competitive market.

- It looks like they are trying to position themselves as a technology supplier to more well-known systems vendors like Airgain, Cisco, Netgear, Intel, and Molex.

- The optical interface business (AOC) is new to me. As we scale up, the typical copper cable just doesn't cut it. So MobiX makes a unit that plugs into a standard port, converts it to optical for transmission, and then decodes it for the end-point.

- They have done two acquisitions and have built up a substantial amount of IP and management expertise. For some reason, companies fail to understand that investors dislike growth by acquisition versus organic growth, so they keep doing it.

- Management is a bunch of ex-Microsemi guys with some Qorvo, Qualcomm and STMicro mixed in. That's not bad.

- There is no presentation of revenue, margins, and growth expectations. It could be due to their early stage of development. Without those, it's hard to build any model. We may see more details before the vote.

So far, "5G" appears to be a massive disappointment. I have heard all the claims and tested many devices. The real results are not good. People tout 300MB routers on 5G networks, and so far, I'd say you're lucky to get 30MB. Often you'll get worse.

The EV is ~$300M, and there is a $30M PIPE and a $100M "equity line" from B.Riley. There is a minimum cash condition of $50M, which could be making people nervous.

I can't see an obvious reason to own this stock at this level. It's a crowded space, and we have no visibility on revenue, growth, and, most importantly, margins and ROIC.

I will circle back as we get closer to the deal and get more information and an updated deck. If not a long, this one might be a short post-de-SPAC.