Retail anticipation was high for the deal thanks to the star power of the "team" which included Donald Jr. but a closer look at the company, the US gun market, and the product/market fit doesn't make sense.

Even worse the premise of company aims to cater to investors yet stands at odds with a vision of an "America First" policy - it takes business away from established firearm dealers and leaves first time gun buyers worse off.

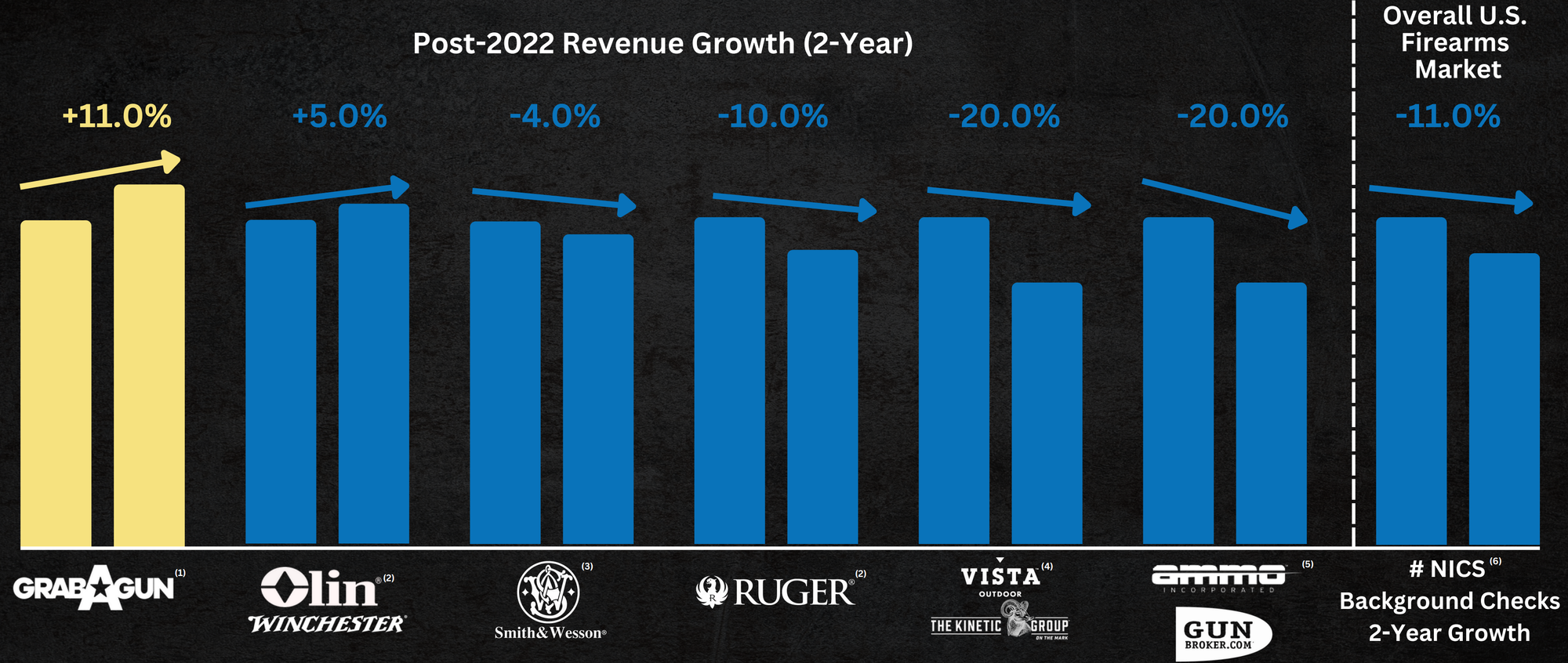

Finally the company describes "The Problem" they are addressing is some "attack on the second amendment" which is not going on. That's the one of the core reasons that the overall market is stagnant. The market was strong in 2021 precisely because people were at least worried about it and now that's the last thing on their minds. The claim that "wokeness" is standing in the way of higher firearm sales is backwards.

Oddly the online gun business has been around for some time in a less flashy form as gunbroker.com $POWW. The stock performance reflects the attractiveness of the business.

There are some ways that $PEW can perform for investors. The first is as a "roll up" of existing, fairly cheap businesses and assets in the space that can at least add bulk to the company and drive earnings growth. The second is serving as a viable online source for many less regulated gun-related components that are hard to find in stock and/or at good prices in traditional channels. Finally the company is embracing the ability to give US consumers the "buy now, pay later" financing option which is not common in most local gun channels which offers some differentiation and add to margins.

The Gun Market is Idiosyncratic and Easy

Lots of people own guns in the US, in most cases, more than one and in many cases a lot more. These folks feel comfortable leaning over a gun counter talking about the benefits of the .300 Winchester over the .30-06.

There are also quite a few related party gun owners in the US - a wife or a husband who wants a gun in the house but relies on their "better half" to figure out and take care of it. If Nate Bargatze thought they needed guns I'm pretty sure his wife Laura would be taking care of it.

Then it gets a bit intimidating. There are handguns, rifles, shotguns, all with different calibers and mechanisms of action, sights, and costs. Blended with that is your intended use, your size and ability to handle a firearm, and budget. There are also federal, state and local regulations that govern legal gun ownership, transport and use. For example you might be able to buy a shotgun over the counter with a routine FBI check but a handgun might require a substantial amount of paperwork and approval steps. Variations between states are striking and always changing.

There is also the matter of training - both for safety and effectiveness. Some larger gun retailers have on-site instructors, classes and live ranges but many do not. This leaves a first time buyer to sort out how and where to find instruction and practice. This is an area where there is some promise but so far the innovators in this space are private companies like American Gun Owners.

Your experience with the gun market will vary greatly based on where you live in the US because state laws (for better or worse) are all over the place, especially with handguns. In some states it's harder to get a permit for a handgun than a CDL and in other states it's as easy as buying weed.

Finally there is a big fly in the ointment in the form of the need for all firearms to be conveyed via a holder of a Federal Firearms License (FFL) holder which is basically your local gun store. You can buy a gun online but it then gets shipped to a local store for pickup - including ensuring compliance and all paperwork is completed. Most dealers are happy to do this and charge a flat fee of $50 or so.

The FFL combined with shifting state and local regulations are where the story gets thorny and potentially problematic. GrabAGun plans to leverage the existing FFL network and plans to offer their own "eGunbook Platform" to help speed the process.

We're gonna have to wait and see how some of this plays out at the point of sale but one can see some basic conflicts as in "we are competing with you directly but plan on leveraging your location, staff and resources to support our distribution model."

Some Numbers

$PEW has done better than many de-SPAC transactions in terms of redemptions which were limited and held up on the first day. After being bid above $20 pre-market the shares settled down at $13.50.

According to the company they ended up with $179M in cash on the balance sheet. With 31M shares outstanding the market cap is $420M.

Last year revenues were reported as $93M with positive EBITDA of $4.7M. I don't have any visibility on where management will guide and how analysts will dial in estimates for 2026 so we will have to wait for that.

Management has made it clear that they are going to deploy some of that $179M cash into M&A which will provide some real direction around how they plan to grow.

On a market cap basis it's at 4x sales and less than 10x EBITDA so no longer demanding in terms of valuation.

In a headline driven market traders will keep pushing the stock around and it can go to $20 as easily as $5. Even announcing some crypto treasury and/or buying firearms with crypto can create a large short-term move.

Maybe the grifters are missing a step here. Where is the interest deduction for first time gun buyers in the BBB? Maybe that's all we need....