Gloo Holdings $GLOO is offering 9.1 million shares at $10-12 via Roth and a cast of tier-3 banks.

Management starts with the good news which is that faith organizations are a big market with over $245B in revenue, hundreds of thousands of organizations and steady growth. It's always been hyper fragmented though and hard to consolidate.

There is a large quality player in the space though called Ministry Brands which seems to be the far better run and investment grade of the two companies. (no position)

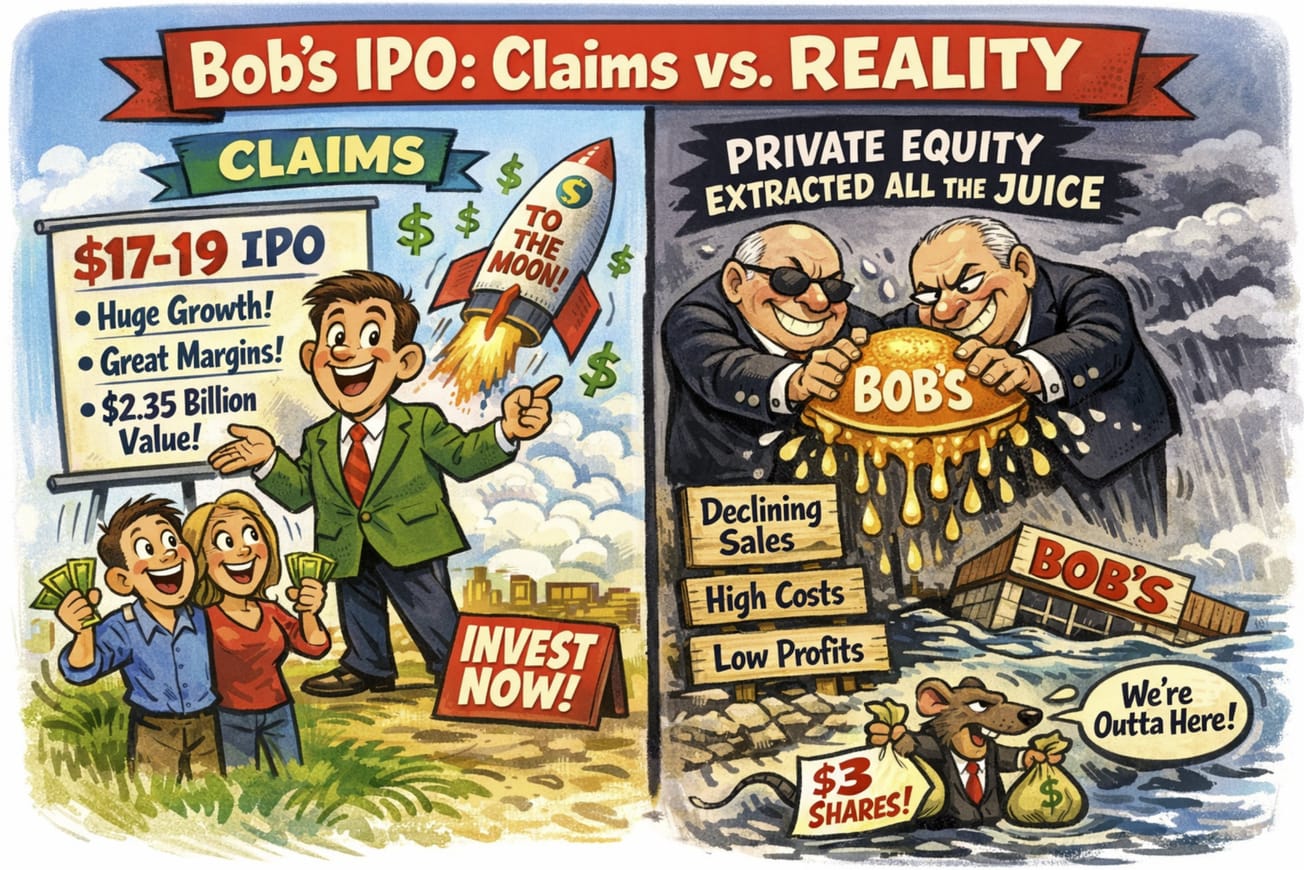

It is a large, underserved market so it's not impossible to create a meaningful business in the sector. Unfortunately the company is saddled with more challenges than opportunities. (see Coming to Jesus below)

Management is of note here with failed Intel $INTC CEO Pat Gelsinger being the Executive Chairman and Head of Technology. The CEO Scott Beck has quite a bit of experience but Blockbuster, Boston Market, Einstein Bros. Bagels are not exactly recent home runs. Still he has more than enough skill to scale the company and run it responsibly. Generally speaking the entire management team experience is concentrated in large companies and brands.

Gloo provides has a product suite for Churches and the like with over 140K on the platform and 57K paying subscription fees. The other side of the platform is used by service providers that provide donor services, marketing, content management, accounting and legal work.

Combining both into a "stack" that includes not just the basic platform but also media and AI services is what the company hopes they can lead them through an inflection point.

Investors will take note that this "platform" is being grown more though acquisition than organic development. The company has been buying up profitable service providers to populate that side of the platform and grow revenue. This doesn't mean it can't work but it makes "growth" harder to pin down.