Ambiq $AMBQ launched their IPO this week. Like many they are hoping to capitalize on demand for "AI semiconductors" and they tell a bold and slightly bizarre story about their ability to bring AI "to the edge" in devices like smart watches and rings.

The deal will be in marketing through next week when they hope to price on July 29th and trade on the 30th. The proposed range is $22-25/share.

Our title comes from the assertion from the company that they are here to solve "the one big problem facing AI today." Everyone involved in this deal should be embarrassed but we'll go through it anyway.

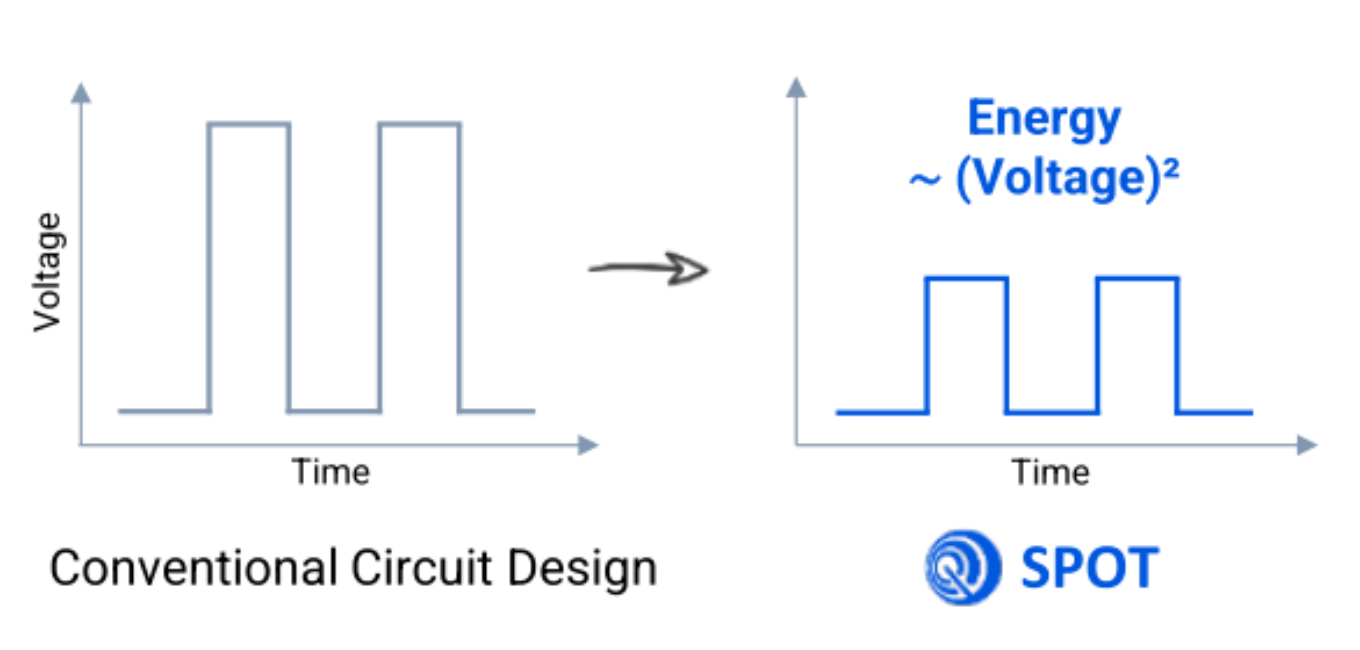

The crux of the innovation is a "lower voltage threshold" which reduces power. The graphic is too fun to leave out.

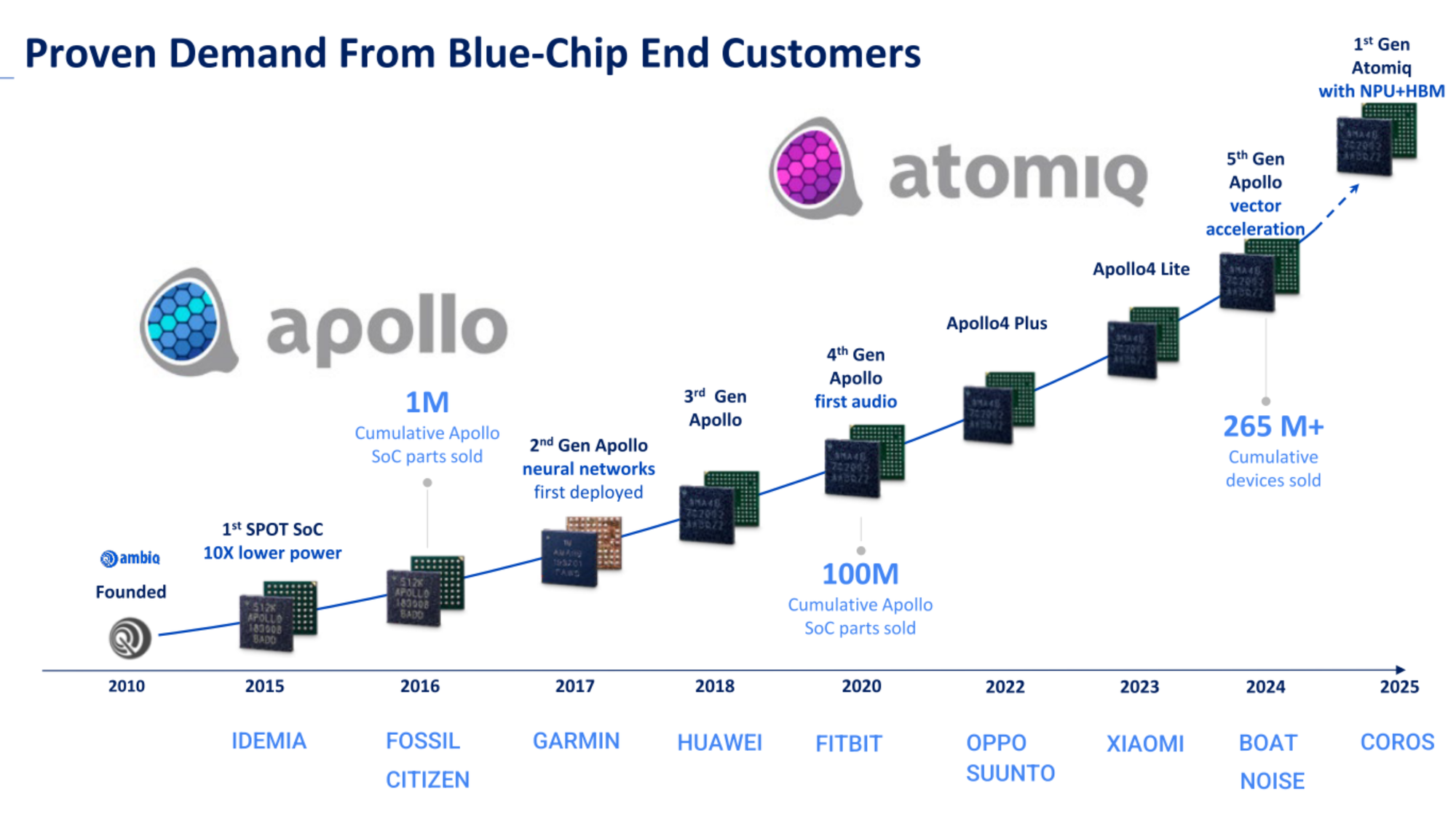

The company has a good track record of product and commercial development (this is not their big problem.). The latest thrust is the planned introduction of their first real "AI" chip the Atomiq which includes a GPU, NPU and DRAM.

There will be markets for edge AI processing, particularly for inference. We've got no disagreement there. Ambiq even has some traction there that can translate into achieving their "1 billion devices deployed" goal. (again not the problem.)

Most of the companies we know of looking at low power edge deployments are aiming to use NVDA provided reference architecture and libraries. Oddly Ambiq provides no context between their SDK and Helios runtime vis a vis CUDA.

So What's the Big Problem?

There has been an established "lower power/edge" market in semiconductors for at least 40 years. I was an observer during the first 20 and for the last 20 have served as an investor and advisor in a few. One had a decent outcome in being acquired several years ago by Renesas $RNECY a $9B revenue company out of Japan.

Structurally low power means lower price and lower margin. The idea was that this could made up on massive volume but it turns out that SAM is smaller than everyone thinks. It happens over and over again.

Ambiq takes great pains to show investors that even though they have no revenue growth overall their non-China business is growing and gross margins are improving.

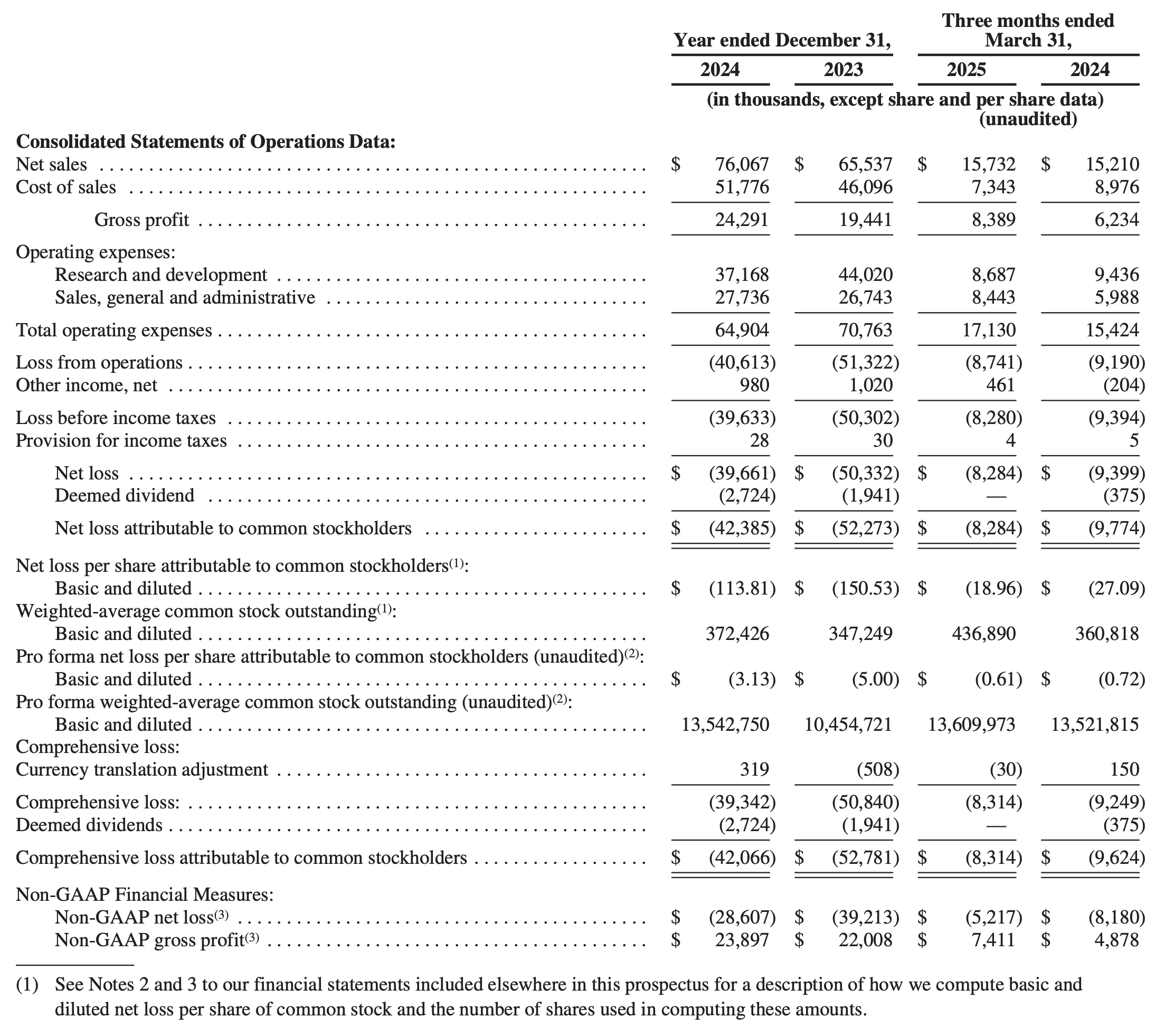

How does a company completely ignore putting operating margins in the slide deck? Sure we're supposed to read the prospectus but I will save you the time.

They lose lots of money and will continue to do so. There's some humor in their "business model" slide since it has no connection with the current business yet asserts that SG&A will be 17% of revenue 5 years from now.

Current numbers are shown below and I would wager that this company fails to ever turn a profit. I'll keep an eye on it and open to be proved wrong. We'll see.

Total shares out after the IPO should be 17.5M and the proposed range is $22-25. If we take the lower bound the market cap will be $385M. This on a sales run rate of $60M.

The company needs to at least double revenue to reach profitability and they are far away from that.

Where might the shares be compelling? If the deal gets done in the range then $7.70 would be cash per share. They will lose money for some time but if they can get some design wins then close to cash would offer better risk/reward.