A surprising 102 SPAC IPO transactions made it into the public markets in 2022.

It's been a punishing market for most of these offerings - only nine are above their $10 starting price.

Half of the companies are trading below $3 a share, and three have declared bankruptcy. We will see many more delistings and bankruptcy out of this group.

As a first step to parsing this universe of stocks into potential longs and shorts, we bucket them into different industries, sectors, and themes. Then some fundamental numbers are added. Some companies are so opaque there are no numbers.

There were also some weird pivots and cross-holdings. MSP Recovery changed its name and ticker to LifeWallet $LIFW, which sounds like a consumer product. But they are in the business of sorting out inappropriate healthcare benefit claims. The LifeWallet offering is an expansion but seems like a trojan horse to deny benefits at the point of care possibly. They also have a staggering 3B "class V" shares outstanding and an "extra" 1B warrants. I'll need to look into that one as a short.

On the cross-holding side, it's weird to see Bioceres Crop Solutions $BIOX spin-off Moolec $MLEC. It seems like a ploy at this stage. It was the last deal done in 2022, and you can find more in our look at Moolec.

Let's go through the high and low lights. The files available for download at the end are there for you in PDF and as a values-only Excel file if you'd like to sort them and play with the data yourself.

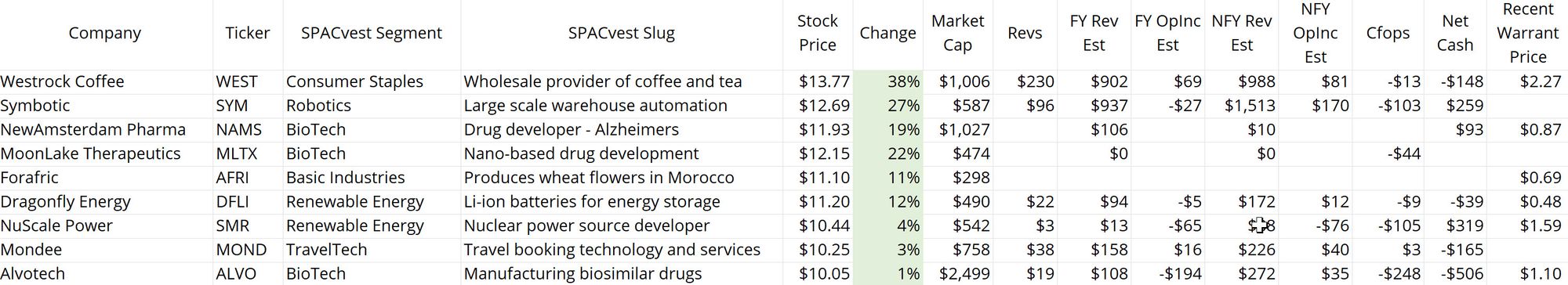

Just a Handful of Winners

Here are the nine names in positive territory. Some look like solid companies, and some might be good shorts here. Let's run down the list.

Consumer staples have been one of the few safer places to invest in recent months, and Westrock $WEST fits the bill there. It's not very risky at 1x sales and profitable on an adjusted EBITDA basis.

Symbotic $SYM is a surprise at #2. It promises a level of warehouse automation that seems like a dream, but they have impressive partners. Analysts project a huge ramp in revenues. They have about 1/2 of their market cap in net cash, though. The main issue for me is that their opportunity is limited to just the largest customers who need to operate giant warehouses at full capacity all the time. That's not the industry norm.

BioTech isn't a focus for us, but three of those deals have done well. MoonLake $MLTX dropped to $3 before making a strong run aided by some positive research coverage. I worked on Alvotech $ALVO because of prior experience with Coherus BioSciences $CHRS, which did their IPO in 2014. Alvotech and Coherus are in the "biosimilar" drug space, which has seemed promising for a long time but has yet to pay off.

It's proved much harder to develop a biosimilar and get FDA approval. It's also very difficult to manufacture these drugs at scale.

Alvotech stresses that they have focused on the "real problem" of scaling up manufacturing from the beginning and believe they will be the ones to crack the code around exploiting this large market opportunity.

But the path to commercialization for these drugs still looks fraught with delays and risks deserving a full note. In short, the regulatory pathway in the US remains rocky; cost advantages are too slim to spur demand, there's lots of competition, and the incumbents are adept at building legal and other obstacles for others to overcome. I'd be more inclined to short Alvotech here, given their $2.5B market, negative cash flow, and outstanding debt. If you like the space, then Coherus might be the one to buy instead.

Dragonfly $DFLY is yet another energy storage company. So far, I've only made money on the short side of these stocks. Dragonfly breathlessly touts its TAM, partnerships, technology, management team, and positioning at "the Nexus of Energy Technology." They don't talk much about sustainable margins and returns on invested capital. There's nothing wrong with Dragonfly - it's just that they are a non-scale maker of batteries, and there are many of them.

NuScale Power $SMR has benefitted from more visibility around nuclear power as fossil fuel prices spiked for a while in 2022. Nuclear has an image problem in many developed economies, especially the US. Energy sources like solar and wind are dandy, but our energy needs are vast. Solar and wind have the disadvantage of being intermittent and requiring storage. Nuclear is being reconsidered as an effective solution for "baseload" power needs now serviced by coal and natural gas. The "sizzle" in the NuScale story is that they are focused on "Small Modular Reactors" (SMR), as in their ticker symbol. The challenge for investors is that there are a lot of advanced nuclear projects right now - about 150 at last count. If I filter the list only to consider SMR, there are still 40.

Nuclear power is a global business, with Russia and China as major players. You have Rolls-Royce, GE, and Westinghouse in Europe and the US. In Japan, there is Hitachi-GE, Mitsubishi, and Toshiba. There are other popular SMR designs, like the SMR-160 from Holtec. The point is that NuScale is a small company competing with giants in a heavily regulated industry. Finally, we have X-Energy coming out as a SPAC IPO via Ares Acquisition $AAC. One advantage NuScale has had is retail interest and the "scarcity value" of being a pure play on SMR. Even that won't be true for long.

Mondee $MOND is an odd company in the TravelTech category. You might consider them a wholesale or white-label travel provider to organizations and "experts" that want access to a larger marketplace of travel offerings at discounted prices. There has been a minor surge in people becoming travel agents again - largely as a home-based side hustle. You can sign up for Mondee at $50/month and try it yourself. They are looking for a head of IR to help them tell the story.

Finally, Forafric $AFRI hasn't figured out how to get wheat to flower. That's a typo to see if you're paying attention. It's just wheat flour. We don't have the full-year numbers yet, but the shares are trading at about 9x EBITDA and 1x sales. That's pretty typical for a company in this sector. If they can expand operating margins in 2023, the shares could perform. Forafric has no analyst coverage yet, but the shares had a very sharp recovery post their drop to $6 in June. Somebody did their work and was waiting. When institutional holdings get printed for Q4, we may find out.

More Ideas & The Full List

There are so many big losers in the group it would take too long to go through them. Some of them are already initiated or completed bankruptcy proceedings. But there are still quite a few interesting companies in the middle that are worth noting and allotting some future research time to.

Let's go through some of those next. Links to the spreadsheet and PDF are included.